Pfizer's stock was not 'delisted from the New York Stock Exchange'

- This article is more than three years old.

- Published on April 22, 2022 at 05:20

- Updated on April 29, 2022 at 06:49

- 2 min read

- By Medha VERNEKAR, AFP Australia

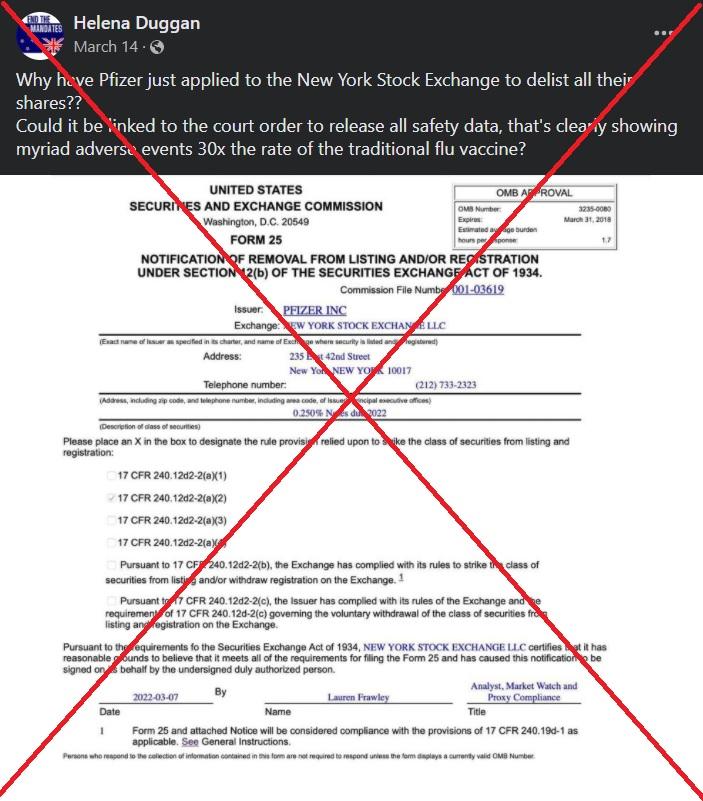

"Why have Pfizer just applied to the New York Stock Exchange to delist all their shares?" reads a Facebook post shared on March 14.

The post suggests the document is linked to a court decision to order the release of documents about the Food and Drug Administration's licensing of Pfizer's Covid-19 vaccine.

The US government agency was responding to a group of scientists who requested expedited access to an estimated 450,000 pages of vaccine data.

Covid-19 vaccine manufacturers, including Pfizer, have been targeted by a wave of misinformation that AFP has debunked.

This document was shared in a string of Facebook posts alongside the same claim, including here and here.

'Certainly not' delisting shares

The Facebook posts actually show a Pfizer application to delist notes -- not shares -- from the NYSE.

A note is a promise from a borrower to an investor to repay debt plus interest at a future date.

Once the debt and interest have been paid off, companies file a Form 25 application to delist notes from the NYSE.

In February 2017, the company announced a debt offering to investors partly consisting of 0.25 percent euro-denominated notes due 2022.

This refers to debt with a payable interest of 0.25 percent due to be repaid in 2022.

"The 0.25 percent Notes due 2022 were euro-denominated notes that were paid in full on March 7, 2022 in accordance with their terms and maturity date," a Pfizer spokesperson told AFP.

Asjeet S. Lamba, head of the finance department at the University of Melbourne in Australia, said the document did not show Pfizer had removed it shares from the stock exchange.

"As the debt instrument has matured, it cannot trade on a market. The company has done nothing else and is certainly not delisting its shares from the US markets," he told AFP.

He said a company like Pfizer was "highly unlikely" to delist its shares from the NYSE.

"Typically, an exchange would delist a company if its share price and trading volume fell precipitously. For example, a company in financial distress," he said.

He pointed to US department store chains Sears and JCPenney, which were kicked off the NYSE in 2018 and 2020 respectively after trading under US$1 for 30 consecutive days, as per stock exchange rules.

Pfizer's stock remains listed on the NYSE and NASDAQ under the symbol "PFE" and is trading at US$49.75, as of April 20, 2022.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us