Nigerian authorities say 5% fuel levy is not among new tax laws coming in January 2026

- Published on September 23, 2025 at 11:53

- 2 min read

- By Oluseyi AWOJULUGBE, AFP Nigeria

“BREAKING NEWS: Nigerians will now pay 5% tax on petrol consumption starting January 2026 under the new tax law!!,” reads the heading of an Instagram post shared on September 3, 2025.

The claim has garnered thousands of shares and comments in different posts on social media, including here on X and Facebook.

Some media outlets have also reported on the claim as a fact, as seen here, here, and here.

However, the claim is misleading.

Old proposal

In June 2025, Nigerian President Bola Tinubu signed four bills to overhaul the country's tax system (archived here).

The reforms are based on recommendations from the Presidential Fiscal Policy and Tax Reforms Committee set up in July 2023 and led by Taiwo Oyedele, former Africa Tax Leader at PriceWaterhouseCoopers (archived here).

Implementation of the new tax laws begins in January 2026 (archived here)

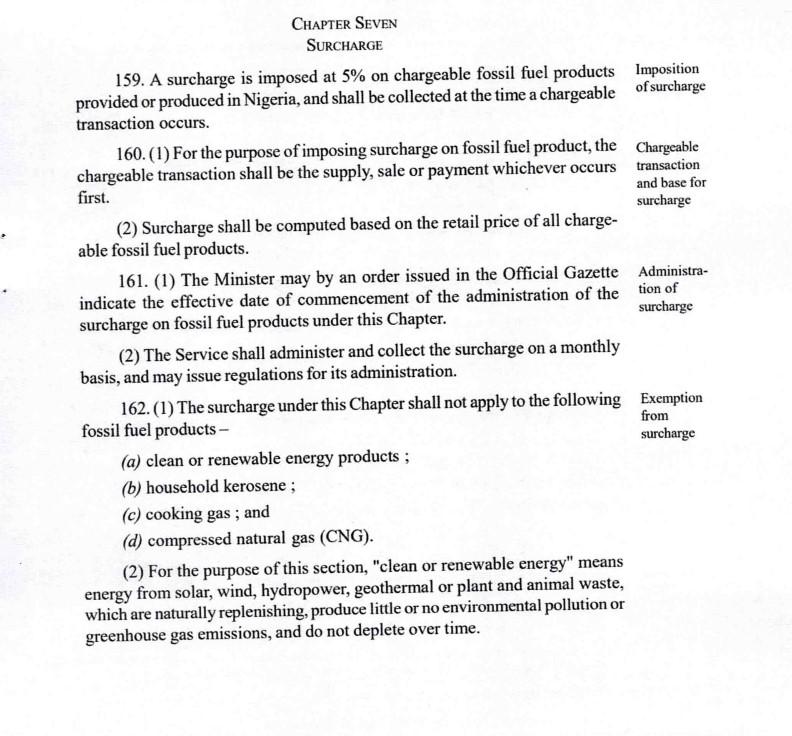

Section 159 of the 2025 Nigerian Tax Act lists a five percent surcharge to be imposed on fossil fuel products (archived here).

However, in an explainer video, Oyedele said the idea of a petrol surcharge was not a new one and that it would not be implemented in January 2026 (archived here).

“There’s a law that was enacted some years back with a surcharge on fuel under the FERMA Act. This is now a provision in the new tax law, and it does not take effect in January 2026,” Oyedele said.

5% petrol surcharge; Mr Taiwo Oyedele has this to say. pic.twitter.com/IBOjJ96BuG

— Daddy D.O (@DOlusegun) September 5, 2025

A 2007 amendment to the Federal Roads Maintenance Agency (FERMA) act provided for a “5% user's charge on pump price of petrol, diesel and of which 40% will accrue to FERMA and 60% to be utilised by the established State Roads Maintenance Agencies” (archived here). However, this surcharge was not put into practice.

Finance Minister Wale Edun also said that the five percent surcharge will not automatically take effect in January 2026 with the new tax laws (archived here).

“Its inclusion in the new law is merely for harmonisation and transparency. There is no immediate plan to implement any surcharge, and as of today, no commencement order has been issued or is being prepared,” Edun told journalists on September 10, 2025.

AFP Fact Check has previously debunked claims about Nigeria’s new tax laws here and here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us