Posts falsely claim proposed Nigerian tax regime to impose a 24% levy on inheritance assets

- This article is more than one year old.

- Published on December 13, 2024 at 15:20

- 3 min read

- By Samad UTHMAN, AFP Nigeria

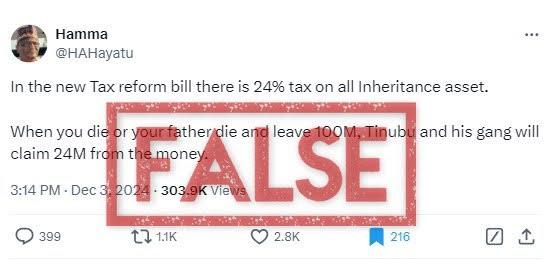

“In the new Tax reform bill there is 24% tax on all Inheritance asset. When you die or your father dies and leave 100M, Tinubu and his gang will claim 24M from the money,” reads an X post that we reposted more than 1,000 times since it was published on December 3, 2024.

The post was shared by an account of a person called “Hamma”, a self-described public analyst and political strategist with more than 82,000 followers. A review of the feed revealed the user frequently publishes content critical of Tinubu and his proposed tax reforms, like here and here.

The claim was also shared by other accounts on X (like here and here) and scores of others on Facebook (here and here).

However, none of the four bills contains a 24% tax imposition on inherited assets.

No 24% imposition

AFP Fact Check thoroughly reviewed the pages of the contentious tax reform bills presented to parliament on October 3, 2024, and found no explicit mention of any provision for taxation on inheritance assets (archived here).

However, a provision under Section 4(3) of the Nigeria Tax Bill may be the origin of the public confusion.

It states that a tax will be imposed on the “income of a family recognised under any law or custom in Nigeria as family income in which the several interests of individual members of the family cannot be separately determined”.

Some online users interpreted this to mean the tax bill would impose an inheritance tax.

But the government has denied this.

“There is no such provision contained in the tax reform bills either directly or indirectly,” said Taiwo Oyedele, the chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, in an X post on December 8, 2024 (archived here).

“Inheritance tax was abolished in Nigeria in 1996 when the Capital Transfer Tax Decree was abrogated.”

Oyedele added that while section 4(3) may sound confusing, it only explained that “the income will therefore be taxed in the hands of individual members where their respective shares can be determined; otherwise, the group will be collectively taxed.”

Experts confirmed the tax authority’s explanation.

Wilson Uchenna Ani, a professor of corporate finance, accounting and taxation at the Michael Okpara University of Agriculture Umudike in Nigeria, said that the provision referred to family income that cannot be separately determined for individual family members.

“This means that if a family's income is combined and cannot be attributed to specific individuals, it will be taxed as a single entity,” he told AFP Fact Check.

What's in the tax bills?

The tax bills intend to simplify tax administration and make Nigeria, which relies on oil for 90 percent of its earnings, more attractive to local businesses and foreign investors (archived here).

The tax reform chair has argued that Nigeria has "over 50 nuisance taxes" — meaning levies paid in small but frequent amounts, usually by consumers (archived here).

If passed, the bills will cut down the number of separate levies paid by individuals and businesses to just "a few", and slash corporate taxes from 30 percent to 25 percent over the next two years.

As a state with a federal fiscal regime, some of Nigeria's taxes are paid into a central pot before being shared out between the central government, the 36 states and 774 local administrations every month.

One of the four bills is widely seen in northern Nigeria as a ploy by Tinubu, a southerner, to further impoverish the region by whittling down its federal allocations of those levies, including for Value Added Tax (VAT).

Besides hiking VAT to 15 percent in the next six years, the Nigeria Tax Bill also changes the system of VAT remittances.

Under the new regime, companies will return the difference between the VAT collected from consumers and VAT paid to suppliers in the state where the goods and services are consumed — not where the company is headquartered.

Although the north grows most of Nigeria's food, agricultural produce is exempted from VAT, and therefore not affected by the hike, while the raw foodstuffs are then often processed in factories in Lagos and other parts of the south.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us