New Nigerian tax laws do not impose 20 percent tax on incomes above 800,000 naira

- Published on September 4, 2025 at 10:57

- 2 min read

- By Oluseyi AWOJULUGBE, AFP Nigeria

“Breaking: Starting January 1 2026, anyone, Nigerian or foreigner, who does business in Nigeria and earns N800,000 or more in a year will have to pay 20% tax on their total yearly income, whether they live in Nigeria or not (sic),” reads the text of a graphic posted on Instagram.

The graphic was shared by Mazi Tundeednut, a popular Nigerian blogger based in the US, to his 4.6 million followers.

The claim was also shared elsewhere on X and Facebook, where it was linked to a dispute between tax authorities and a popular Nigerian TikTok influencer known as Peller.

Earlier in August, Peller, whose real name is Habeeb Hamzat, revealed that he had received a demand notice of 36 million naira (about $23,500) from the Lagos State Inland Revenue Service (LIRS) for tax arrears (archived here).

However, the claim that the government has introduced a blanket 20 percent tax on all people, in and out of the country, earning more than the equivalent of $500, is false.

Sliding scale

On June 26, 2025, Nigerian President Bola Tinubu signed four bills into law, aimed at overhauling the country's tax system (archived here).

The reforms are based on recommendations from the Presidential Fiscal Policy and Tax Reforms Committee set up in July 2023 and led by Taiwo Oyedele, former Africa Tax Leader at PriceWaterhouseCoopers (archived here).

Under Nigerian laws, individuals are required to pay personal income tax, which is structured into income brackets.

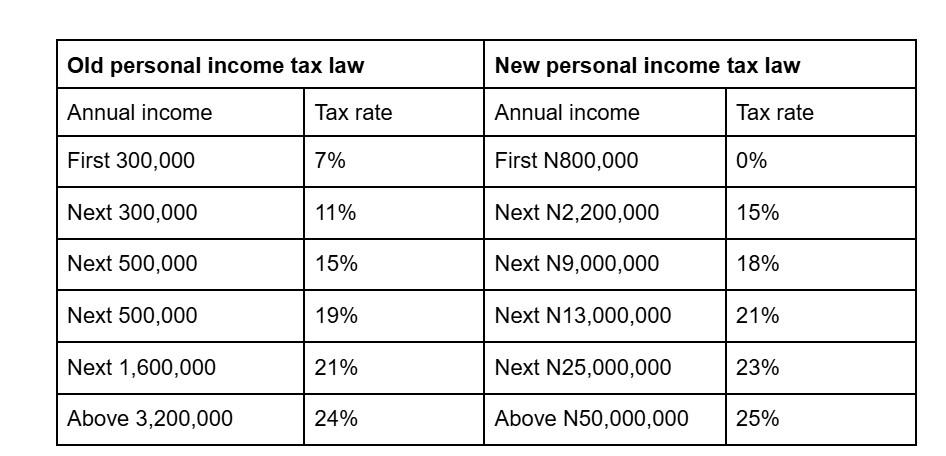

Under the previous law, the first 300,000 naira of a person’s annual income was taxed at seven percent and the next 300,000 naira at 11 percent (archived here).

With the amendment, the first 800,000 naira of a person’s annual income will be tax-free, while a 15 percent personal income tax rate applies to the next 2.2 million naira (archived here).

The full personal income tax rate is shown in the table below:

The new tax laws maintain a progressive system, where different portions of an individual’s annual income are taxed at different rates, and do not use a blanket tax rate as alleged in the viral posts.

Investment analyst, Bolaji Fesomade, reiterated this on X (archived here).

1. From January 2026, anyone earning ₦800,000 or less in a year pays zero tax. That’s the law. No guessing.

— Bolaji Fesomade (@MasterBolaji) August 28, 2025

2. The tax is progressive, not flat. If you earn ₦12 million in a year, the first ₦800k is free, the next ₦2.2m is taxed at 15%, and only the higher part enters 18%.

“The tax is progressive, not flat,” he wrote. “If you earn ₦12 million in a year, the first ₦800k is free, the next ₦2.2m is taxed at 15%, and only the higher part is taxed at 18%. Your effective tax rate will be far lower than 18% on the whole ₦12m.”

AFP Fact Check has previously debunked claims about Nigeria’s new tax laws here and here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us