Videos mislead on Heritage Foundation 'Saving the Family' report

- Published on February 6, 2026 at 23:11

- 4 min read

- By AFP USA

The conservative Heritage Foundation introduced a new major policy document in early 2026 with recommended incentives for young Americans who marry and birth large families. The document proposes new tax credits for having children and encourages the creation of marriage "bootcamps," but contrary to videos spreading across social media, it does not call for instituting a penalty against unmarried, childless women over the age of 30.

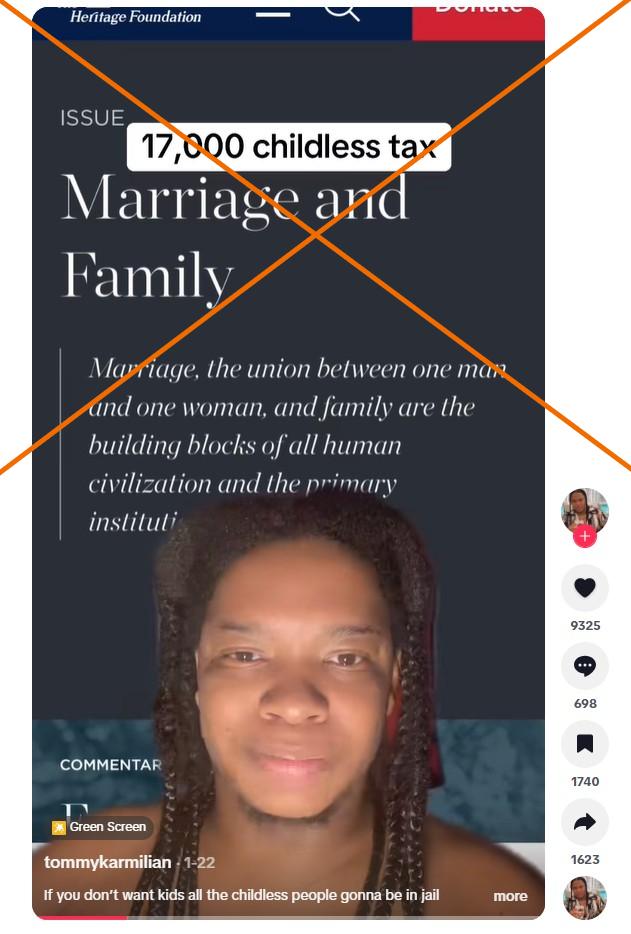

"The Heritage Foundation is charging people $17,000 if you do not have a kid by age 30," a TikTok user says in a January 22, 2026 video.

"They're charging people for not having kids. You have to pay the government $17,000 for not having a kid."

Similar claims reverberated online, accruing millions of views across Facebook, Threads, YouTube, TikTok, Instagram, BlueSky and X.

Some posts mention the Heritage Foundation's "Project Esther" as the source of their claim, while others point to the organization's former lobbying head Russell Vought, who now leads President Donald Trump's Office of Management and Budget (archived here and here).

The Heritage Foundation is the conservative policy organization behind Project 2025 (archived here), a blueprint for reshaping the federal government that has influenced many of the reforms Trump has implemented in his second term.

On January 8, 2026, the group published a lengthy report focusing on the declining birth rates in America. It is titled: "Saving America by Saving the Family: A Foundation for the Next 250 Years" (archived here).

The mentions of "Project Esther," meanwhile, refer to another real document the organization released in October 2024, with the stated goal of targeting antisemitism (archived here).

However, an annual "tax penalty" for singles is a misreading of both documents' recommendations.

"Nowhere do we propose tax increases," a Heritage Foundation spokesperson told AFP on February 6, 2026.

Proposed tax credit

The organization's January report argues that the federal tax code and social safety net programs should be redefined "through a pro-family lens."

Colin Gordon, an American public policy and political economy historian at the University of Iowa, told AFP the claims spreading online about a supposed penalty for unmarried, childless adults were likely distorted from tax incentives the document suggests offering to married couples (archived here).

"In both Project 2025 and the new report, Saving America by Saving the Family, Heritage proposes a variety of changes to social and tax policy that would reward or incentivize both marriage and parenthood," Gordon said in a January 30 email.

"Single, childless tax filers would not be directly penalized; they would just not be eligible for the new credits."

As an example of what such an incentive may look like for a married couple, he pointed to page 9, which says: "Congress should apply the current $17,670 adoption tax credit to married parents for each of their own newborns."

Shawn Fremstad, a law and political economy consultant (archived here), agreed that the social media allegations likely conflated two different benefits proposed by the organization.

The $17,000 benefit -- which does not have an age cap for parents -- presents as a "welfare bonus" for "middle-and upper-middle-income married parents and their kids," he told AFP in a February 4 email.

The other benefit misleadingly thrown in the mix, according to Fremstad, is the "NEST benefit" -- a "Newlywed Early Starters Trust" -- which does describe age specifications. The document says it would offer tax rewards for "men and women who marry by or before the current average age of first marriage (about age 30)."

He noted: "I don't think it's accurate to imply that it penalizes adults who aren't parents."

'Bootcamps'

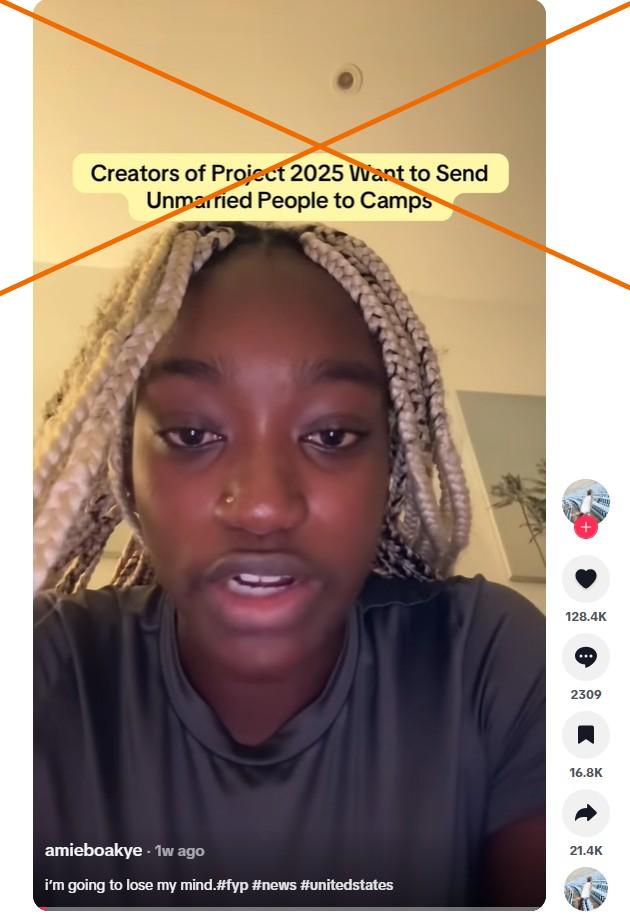

One post also alleges a "$280 billion initiative to send unmarried people to government-sponsored marriage camps."

The idea behind a marriage "bootcamp" for "cohabiting couples with children" does come from the report.

"Similar programs already exist and are designed to assist typically co-habiting couples who are considering marriage," the Heritage Foundation told AFP.

The report also suggests that schools "cultivate a local marriage culture by using faculty and graduate students in the appropriate disciplines to offer pre-marital education and counseling services."

Jessica Waters, director of the American University School of Public Affairs (archived here), told AFP on February 5 that the "bootcamp" and other elements of the report paint higher education -- especially for women -- in a bad light.

The report makes the case that the historical increase in the rate of women earning bachelor's degrees "is negative because it 'correlates' (their words, not mine) with later marriage and fewer children," Waters said in an email.

The Heritage Foundation spokesperson responded that "too many Americans, both male and female, are trapped by student loan debt and feel stuck working in low paying jobs that don't actually require the degrees they obtained."

Criticism

The experts AFP spoke to said the proposed tax incentives would create inequalities -- even if those effects do not primarily impact single, childless people.

The most penalized groups, they argued, would be single parents, parents who live together and are not married, and parents with non-biological children.

Democratic lawmakers have also raised alarm over the proposals' impact on historically underrepresented groups.

"You are clearly penalizing same-sex couples, and the constitutional right of marriage says not only that you have to let same-sex couples marry, but that they have to have access to the same constellation of benefits as opposite-sex couples," said Joanna Grossman, a law professor at Southern Methodist University's Dedman School of Law (archived here).

"Giving you a bonus only if you're married, and only if you have biological children" could violate people's constitutional rights under the Fourteenth Amendment, she told AFP on February 4.

Asked why the report distinguishes between "non-biological" and "biological" children, the Heritage spokesperson said adoption tax benefit programs "already exist."

AFP previously debunked claims involving Project 2025.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us