Posts falsely claim Nigeria was 'debt-free' after settling IMF loans

- Published on June 3, 2025 at 10:32

- 2 min read

- By Samad UTHMAN, AFP Nigeria

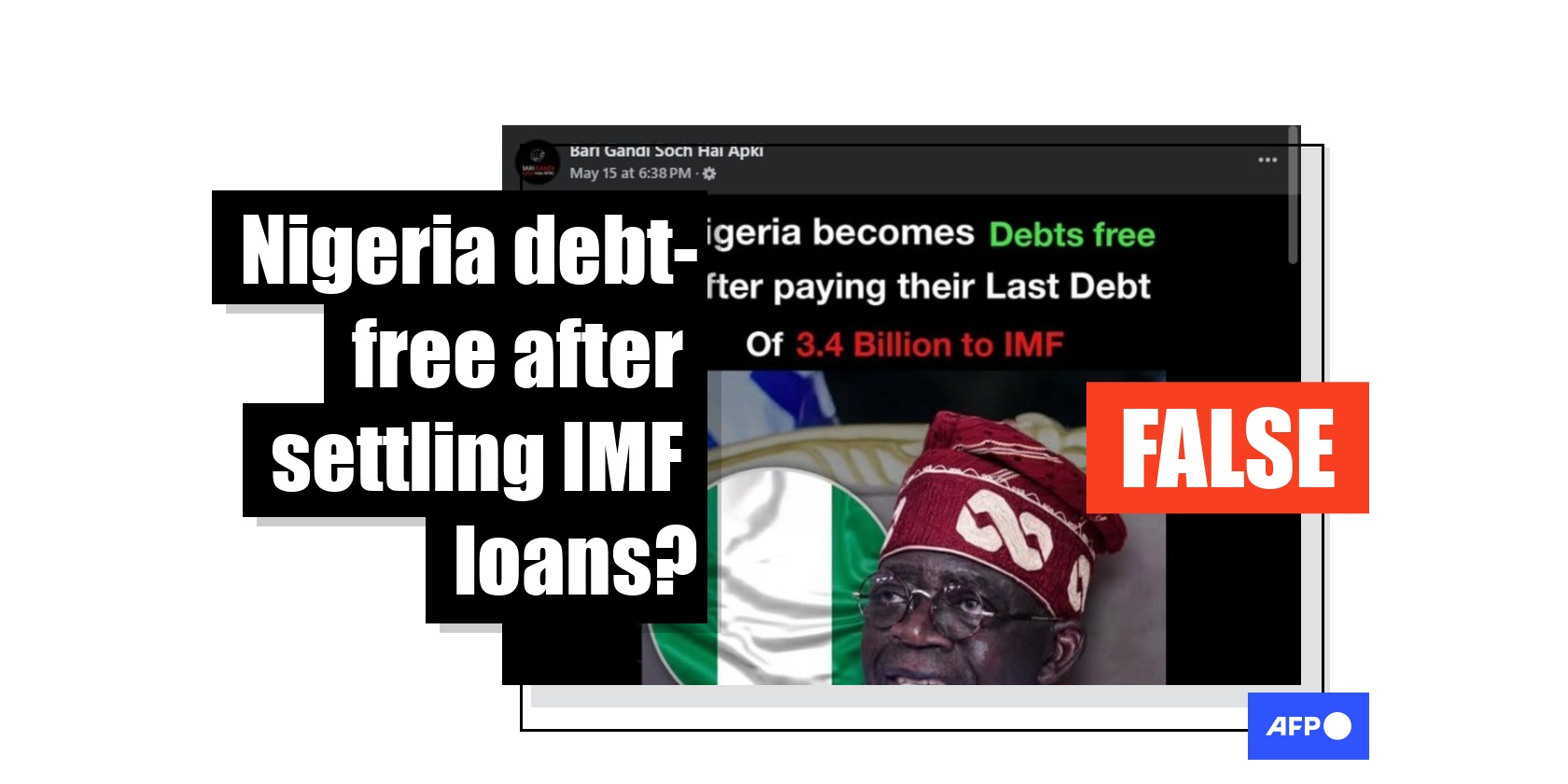

“BREAKING NEWS!!! Good news- Nigeria is finally debt-free,” read the caption of a Facebook post published on May 16, 2025.

Nigerian President Bola Tinubu was pictured in the post alongside text that read, “Nigeria is finally debt-free after paying $3.4 billion to the IMF”.

In a statement to local newspapers on May 8, 2025, the IMF confirmed that Nigeria has fully repaid the $3.4 billion loan obtained under the so-called Rapid Financing Instrument to cushion the economic impact of the Covid-19 pandemic — later corroborated by the Nigerian government (archived here and here).

An identical claim was shared hundreds of times on Facebook, including in Ghana and Pakistan.

However, the settling of the IMF loan does not mean Nigeria is debt-free.

Unpaid borrowings

AFP Fact Check searched the DMO’s website where Nigeria’s public debt is disclosed and found that as of December 31, 2024, the nation had outstanding loans of more than $46 billion, excluding the $3.4 billion repaid to the IMF.

According to a factsheet published by the DMO on April 4, 2025, the unpaid debt is held by “multilateral, bilateral, and commercial” creditors. So-called multilaterals constitute the largest share with a total of $22.32 billion, just under half the total external debt (archived here).

Key multilateral lenders include the World Bank Group – with the International Development Association (IDA) accounting for $16.56 billion and the International Bank for Reconstruction and Development (IBRD) $1.24 billion – and the African Development Bank Group, which collectively holds over $3 billion in Nigerian debt.

Bilateral debts amount to $6.09 billion (13.30 percent of the total), with China’s Exim Bank owed $5.06 billion. Other bilateral lenders include France’s Agence Française de Développement, Japan’s JICA, India’s Exim Bank, and Germany’s KfW.

Commercial debt stands at $17.32 billion (37.83%), primarily from Eurobonds. Additionally, syndicated loans from institutions like Deutsche Bank AG contribute a smaller portion, totaling $54.87 million (0.12%).

Meanwhile, Nigeria’s debt pile may balloon should the country’s legislature approve Tinubu's fresh $24.14 billion loan proposal. By the end of 2026, the West African nation may be wallowing in roughly $69.92 billion in loan servicing (archived here).

AFP Fact Check previously debunked claims about Nigeria's relationship with the IMF here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us