Post misleadingly claims former Nigerian leader secured $3.4bn IMF loan in 2020

- This article is more than one year old.

- Published on November 15, 2024 at 15:51

- 3 min read

- By Samad UTHMAN, AFP Nigeria

“Buhari is the first and only Nigerian president to take an IMF loan. He took a $3.4bn loan from the IMF, including several loans from the World Bank. Now, the World Bank is bad, but the World Bank gave developmental loans to Kano and Kaduna,” reads part of an X post that has garnered more than 300 shares since it was published on November 11, 2024.

Likening Nigeria’s economic policies under Tinubu to Malaysia’s reforms two decades ago, the post blames Buhari for lacking the courage to remove petrol subsidies and implement a flexible foreign exchange regime.

The post was shared by an account called “Dr. Toks” with more than 117,000 followers. The account posts regularly about the Nigerian economy.

Buhari, a former military head of state, democratically led Nigeria for eight years from 2015 to 2023, when Tinubu took over from him. Both men are from the All Progressives Congress (APC) political party (archived here).

In 2023 Tinubu declared an end to the petrol subsidy on his first day in office and freed up the naira currency, changes that government officials and analysts say will revive the economy and attract investors.

Meanwhile, the population is suffering the harsh effects of these policies which have set inflation at a three-decade high while the cost of living has soared (archived here).

However, the social media post's claim that Buhari secured an IMF loan in 2020 is misleading.

Funds for Covid

Nigeria joined the IMF in 1961, and like every other member state, the government is obligated to save funds in a global reserve account called Special Drawing Rights (SDR).

The value of the SDR is based on a basket of the world’s five major currencies – the US dollar, euro, yuan, yen and the UK pound (archived here).

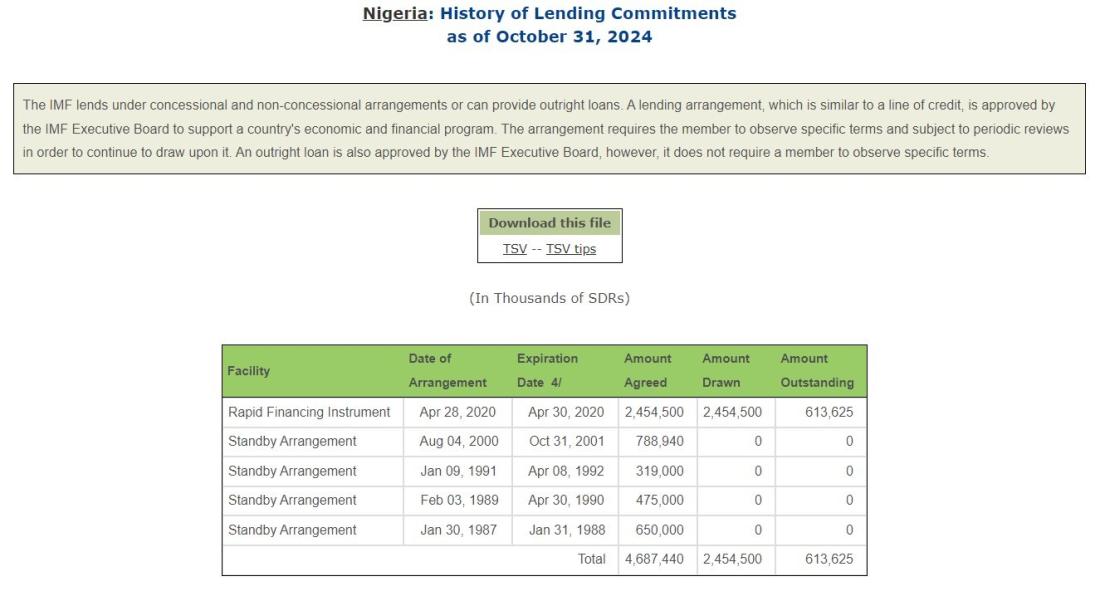

As of 2020, Nigeria had total reserves of SDR 2.4 billion worth about $3.4 billion with the IMF (archived here).

Faced with the need to cushion the severe economic strain caused by the Covid-19 pandemic and the collapse in global oil prices, Nigeria requested emergency support from the IMF.

The request was approved on April 28, 2020, under the IMF’s Rapid Financing Instrument (RFI) and saw Nigeria draw down on the entire balance in its IMF reserve (archived here).

The RFI is intended to help a country in time of crisis with urgent financial support unencumbered by all the usual conditions of an IMF loan (archived here).

In terms of the arrangement, Nigeria did not take out a conventional loan, although it has been repaying the withdrawn amount with interest. As of October 31, 2024, the country owes SDR 613 million ($838 million).

Before the 2020 withdrawal, Nigeria made four other lending requests to the IMF (in 1987, 1989, 1991 and 2000) but ultimately declined the facilities.

“Since becoming a member of the IMF in 1961, Nigeria has actively engaged with the IMF to address economic challenges and support economic stability,” IMF communication officer Devahasadin Pavis said in an email to AFP Fact Check. “While several financing arrangements were approved over the years, Nigeria only drew on the Rapid Financing Instrument in 2020. Nigeria has also provided resources to the IMF to help support member countries respond to the 1970s oil price shock.”

“Nigeria has entered several Stand-By Arrangements (SBAs) with the IMF; however, no drawdowns were made under these facilities. In 2020, the IMF approved a Covid-19 emergency financing package of SDR 2,454,500,000 (US$3.4 billion) under the Rapid Financing Instrument with a maturity of five years and a grace period of two years; the outstanding balance on the facility is currently SDR 613.62 million (US$838.14 million),” Pavis added.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us