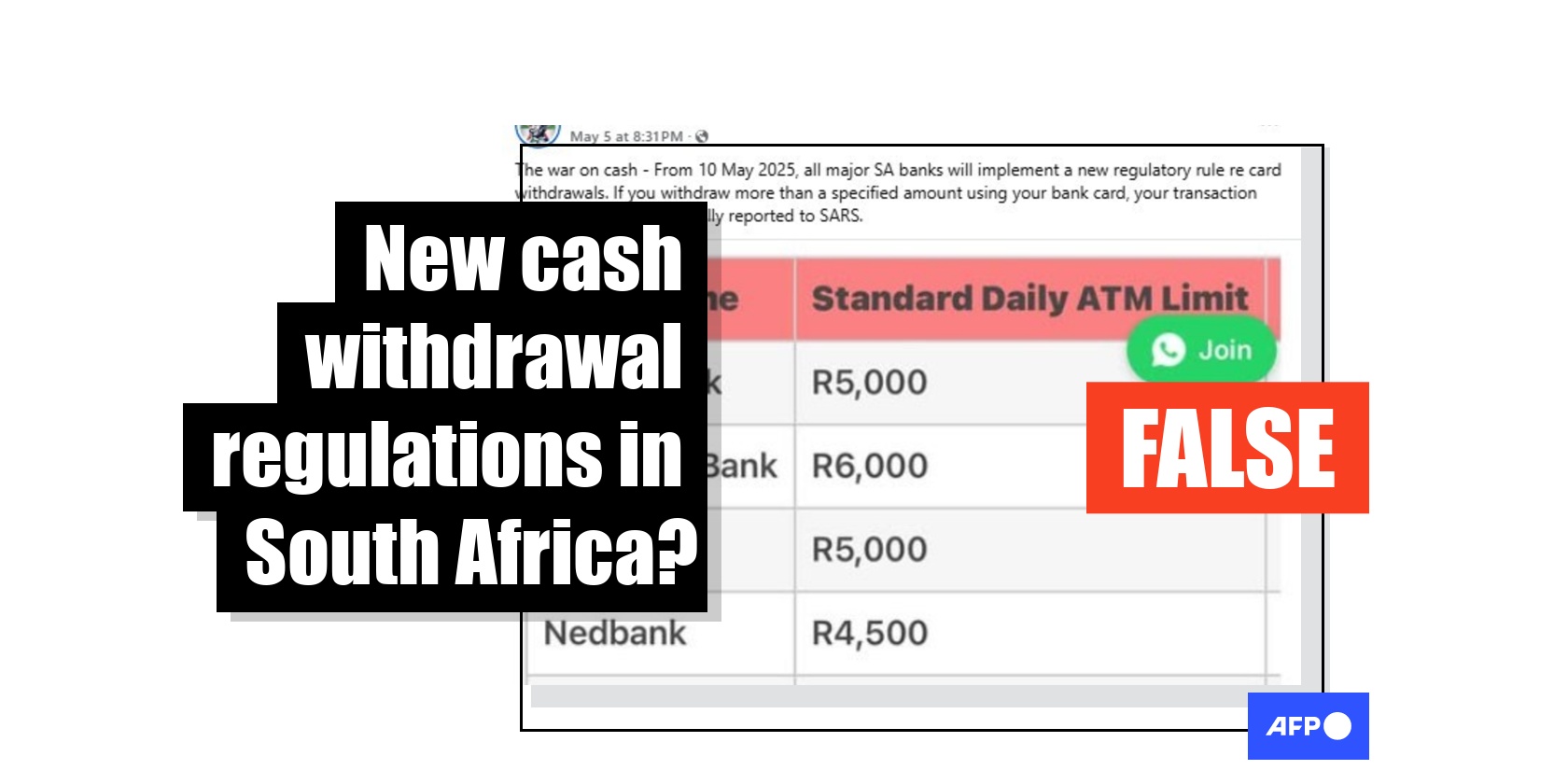

Posts falsely claim South Africa has imposed new rules for reporting cash withdrawals

- Published on May 20, 2025 at 16:37

- 3 min read

- By Tendai DUBE, AFP South Africa

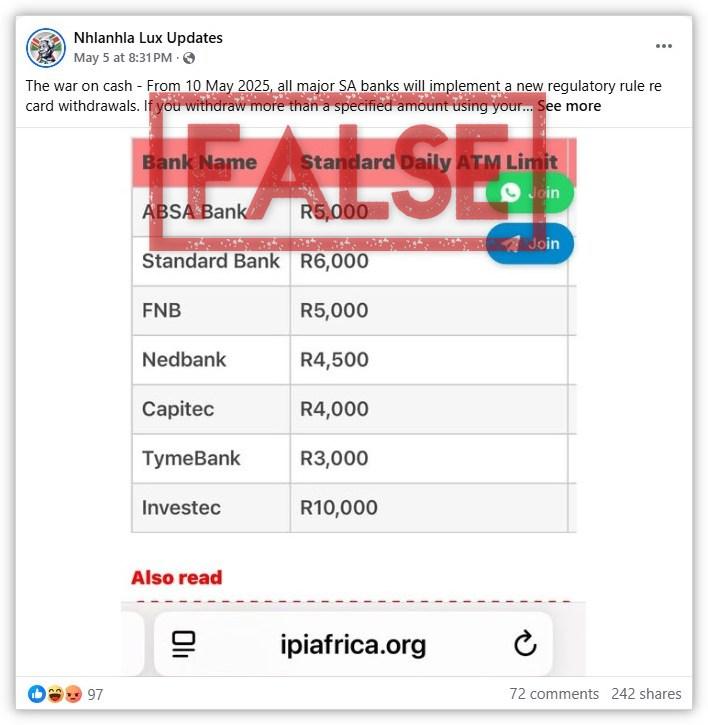

“The war on cash,” begins a Facebook post published on May 5, 2025. “From 10 May 2025, all major SA banks will implement a new regulatory rule re card withdrawals.”

Shared more than 240 times, the post further claims that “if you withdraw more than a specified amount using your bank card, your transaction details will be automatically reported to SARS”.

SARS stands for the South African Revenue Service.

The post includes a screenshot of a table purportedly showing the various withdrawal amounts that automatically trigger notification to SARS for each of South Africa’s banks, ranging from R3,000 to R10,000 a day (approximately $166 to $553).

The same claim was shared on other platforms, including Facebook, Instagram, and LinkedIn.

Other posts and blogs claimed the new rules would take effect on June 15, 2025.

But the claims are false.

Dodgy web domain

A keyword search found no credible reporting of the claim, but it appears to be linked to this blog article from May 2, 2025: “SARS Big Bank Alert! Withdraw Over This Limit After 10 May and SARS Will Be Notified Instantly”.

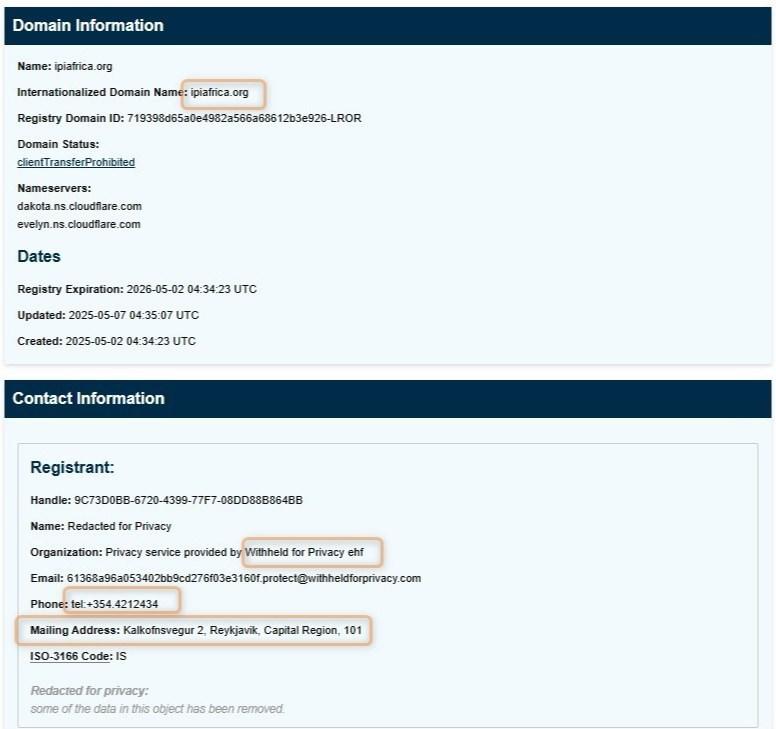

The article comes from a website designed to look like an African-focused news blog, the domain of which – “ipiafrica.org” – appears in the false Facebook post.

AFP Fact Check used Whois and ICANN domain lookups and found the blog’s URL was registered on May 2, 2025 – the same date as the article – with a listed address and phone number based in Iceland.

A Google search of the address shows it was the subject of a 2024 New York Times report about Withheld for Privacy, an internet privacy service established by Namecheap, which hosts some of the internet’s “sketchiest websites” (archived here).

The NYT report stated Iceland has emerged as a global hub for dubious websites, largely due to its strong privacy laws.

Other stories published on the website also appear questionable, most with clickbait headlines about South Africa.

‘No new directive’

The South African Reserve Bank, the country’s central bank, refuted the claim on Facebook (archived here).

“The article claiming that a 'New Card Withdrawal Rule' will take effect on 10 May 2025 — requiring banks to report card withdrawals over R10,000 to SARS — is false,” it said.

The SARB statement added that “no such rule” had been issued, nor was there “a new directive” announcing a requirement for “automatic SARS reporting for large card withdrawals”.

The bank urged the public to verify financial news on official SARB or SARS platforms.

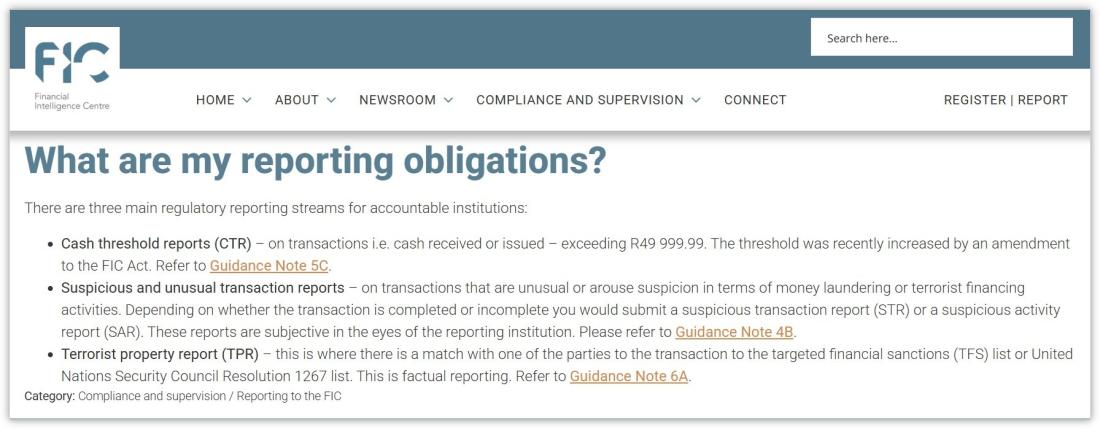

Contacted by AFP Fact Check, South Africa’s Financial Intelligence Centre (FIC) reiterated this in an email on May 14, 2025, saying it has not made any recent “announcements or regulatory changes on this subject”.

The FIC said, in this instance, the Prudential Authority of the South African Reserve Bank (SARB) would have communicated such a change.

The FIC said by law, “cash received or paid out to a client above the threshold of R49,999.99 (approximately $2,800) must be reported by the accountable institution to the FIC”.

The FIC’s primary role is to protect the integrity of the country’s financial system; it was established to identify proceeds of crime, to track the financing of terrorism, and to combat money laundering.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us