House budget resolution did not eliminate taxes on tips, overtime

- Published on March 3, 2025 at 16:41

- 3 min read

- By Bill MCCARTHY, AFP USA

"No taxes on tips or overtime just passed. Promised made, promises kept," conservative American actor Kevin Sorbo, who has previously spread misinformation, said in a February 25 post on X.

At least two Republican lawmakers, who both voted for the resolution, joined in on the victory lap.

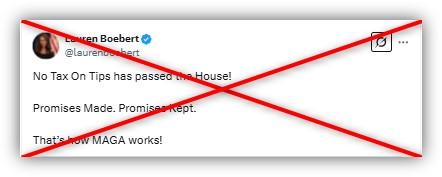

"No Tax On Tips has passed the House! Promises Made. Promises Kept. That's how MAGA works!" said Congresswoman Lauren Boebert.

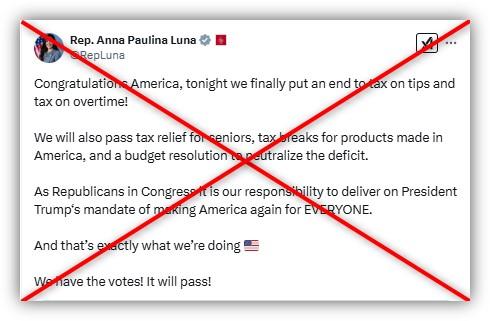

Congresswoman Anna Paulina Luna added in a since-deleted post: "Congratulations America, tonight we finally put an end to tax on tips and tax on overtime!"

Similar posts spread across X and other platforms such as Instagram, amplified by Donald Trump Jr and other prominent conservative accounts. Some posts took aim at Democrats who opposed the measure, claiming that the entire party had voted against weeding out taxes on tips and overtime.

Eliminating taxes on these two income streams was a major campaign promise for Trump, who pledged to do so as soon as he entered office. The posts shared online could leave the impression that this goal was achieved -- and that income gained from tips or overtime pay is no longer reportable to the Internal Revenue Service, or IRS.

But the budget resolution the House passed February 25 did not change tax law.

Nowhere in the measure -- which passed by a 217 to 215 vote, with one Republican siding with 214 Democrats in voting against -- are tips or overtime even mentioned (archived here and here).

"Republicans haven't changed the law yet," said Joshua Huder, a senior fellow at Georgetown University's Government Affairs Institute, who specializes in Congress, the legislative process and the federal budget process (archived here).

A budget resolution

A budget resolution, according to the Congressional Budget Office, is "basically a blueprint" to guide action on budget-related legislation (archived here).

The nonpartisan agency's website states: "It does not provide funding for federal programs or change tax law; rather, it sets overall spending and revenue targets, sometimes for as many as 10 years. A budget resolution is not a law, because it is not signed by the president; it takes effect if approved by both Houses of Congress."

Budget resolutions represent the first step in a special legislative process known as reconciliation, a fast-track pathway for Congress to implement policy (archived here and here).

Reconciliation begins with the House and Senate agreeing on a concurrent resolution, which does not require the president's signature but also does not carry the force of law. Often the adopted resolution will include specific instructions for congressional committees to adjust spending or revenues. When this is the case, the committees will then draft legislation to do so.

The resulting legislation combines to form the reconciliation bill, which can pass each chamber with a simple majority vote and limited debate time before heading to the president's desk.

The House Republicans' latest resolution sets the framework for negotiations aimed at ushering in Trump's hardline agenda on immigration, tax reform and deep spending cuts. It instructs House committees to find a total of $2 trillion in spending cuts (archived here). It directs the House Ways and Means Committee to cut $4.5 trillion in taxes over the next decade.

The Senate previously passed a competing budget blueprint, which will have to be squared with the House version.

"Right now, they are debating a budget resolution that only passes through the House and Senate," Huder told AFP. "This will create a process where Republicans could change the law with only a majority vote in both chambers. In other words, there would be no filibuster on a future bill if they can pass this budget."

He said nothing has changed yet. "Instead, they're still debating on what they want to do to change law later. They need to pass an entirely different bill to change the law."

Lawmakers have separately introduced several bills that would end taxes on tips, such as the "No Tax on Tips Act."

The IRS website says all tips received are income subject to taxation (archived here).

AFP has debunked other misinformation about US politics here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us