Trump tax cuts misrepresented ahead of US filing deadline

- This article is more than one year old.

- Published on March 13, 2024 at 19:47

- 3 min read

- By Daniel FUNKE, AFP USA

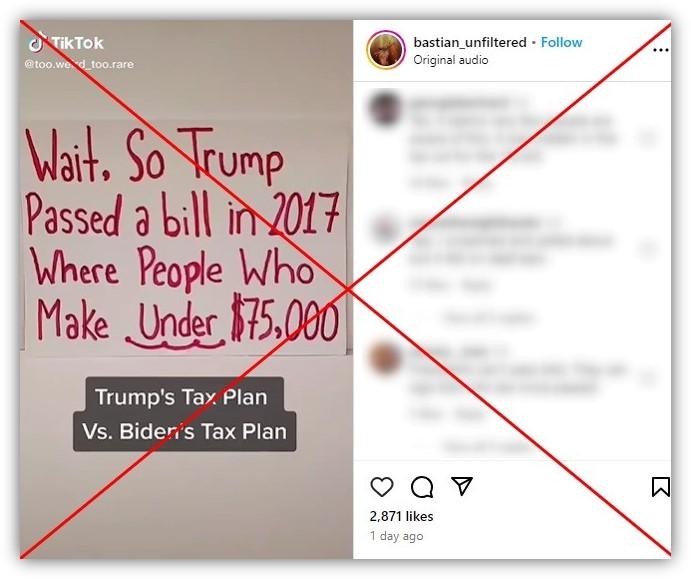

"Wait, So Trump Passed a bill in 2017 Where People Who Make Under $75,000 will have their taxes raised in 2021 and Every 2 years after that until 2027 while the Rich Get Richer," says a pair of notecards in a video shared March 11, 2024 on Instagram.

"And y'all crying about Biden raising taxes for People Who Make Over $400k?"

Text over the clip, first published in November 2020 on TikTok, says: "Trump's Tax Plan Vs. Biden's Tax Plan."

Posts sharing the claim have circulated elsewhere on Instagram and TikTok ahead of the April 15 deadline for Americans to file their tax returns (archived here), without specifying whether this figure referred to individuals or families.

The narrative pits Trump's record against that of President Joe Biden as the pair prepare for a rematch in the 2024 election. Both have won enough delegates to clinch their party nominations, setting up one of the longest campaigns in US history.

Trump signed the Tax Cuts and Jobs Act (TCJA) in December 2017 (archived here), kickstarting dramatic reductions for corporations and temporary discounts for individuals. Democrats branded the plan -- the first major legislative accomplishment of Trump's term -- as a giveaway to the wealthiest that risked blowing a hole in the national debt.

But the legislation does not explicitly raise taxes for Americans with annual salaries less than $75,000, as other independent fact-checking outlets have reported.

"The Trump cuts on average lowered taxes for most households, including on average those earning less than $75,000," said Eric Toder, a fellow at the Urban-Brookings Tax Policy Center at the Urban Institute (archived here), in a March 12, 2024 email.

'Not accurate or representative'

The claims shared online appear to stem from a Joint Committee on Taxation (JCT) report published in December 2017 (archived here). The nonpartisan congressional research committee estimated that, starting in 2021, Americans in several income categories below $75,000 would start to see their federal taxes increase.

But William McBride, vice president of federal tax policy at the nonprofit Tax Foundation (archived here), told AFP in a March 12, 2024 email that the online claims are "not accurate or representative of how the 2017 Tax Cuts and Jobs Act works."

That is because the JCT report accounts for a TCJA provision that eliminated a tax penalty for Americans who do not maintain a minimum level of health insurance coverage under the Affordable Care Act (ACA) (archived here and here). Internal Revenue Service data from 2014 to 2018 (archived here) show households making less than $75,000 annually shouldered the bulk of those costs, according to a Tax Foundation analysis (archived here).

The JCT treats the elimination of that penalty as a net tax increase -- not a decrease -- because it assumes fewer people will purchase health insurance on public marketplaces, thereby forgoing the subsidies associated with those plans (archived here).

McBride said the JCT report "is not consistent" with other analyses that isolate the effects of the TCJA and exclude the ACA policy changes.

Using estimates from the JCT, the Congressional Budget Office reported in 2017 that the law would actually reduce taxes on average for all income groups through 2025, when the legislation is set to expire (archived here). Both the Tax Foundation and the Tax Policy Center (TPC) reached similar conclusions (archived here and here).

Toder of the TPC said that if the cuts expire, Americans making less than $75,000 annually "will see their taxes go up." Calculations from the Tax Foundation back that up (archived here).

"However, Biden has said he won't raise taxes on people making less than $400,000 and Trump has talked about extending the 2017 tax cuts," he said. "So, it is likely that in reality taxes will not go up, although they would if Congress took no action."

AFP has fact-checked other misinformation about the Trump tax cuts here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us