Posts overstate debt impact of Trump tax cuts

- This article is more than two years old.

- Published on November 7, 2023 at 22:48

- 4 min read

- By Daniel FUNKE, AFP USA

"Holy cow, Donald Trump's tax cuts for the obscenely wealthy are responsible for a QUARTER OF OUR NATION'S ENTIRE DEBT and Republicans want to cut YOUR social security to pay for it -- and that's what this debt ceiling bullsh*t is all about," says text in an October 29, 2023 Instagram post from Occupy Democrats, a liberal advocacy group.

The post accrued more than 20,000 likes and spread across Instagram.

Occupy Democrats attributes the claim to social media user Jacqueline Reynolds, who originally published it October 28 on X, formerly known as Twitter. Her post and a subsequent follow-up accumulated tens of thousands of likes and shares.

The narrative percolated online less than six months after President Joe Biden signed a bill to extend the debt ceiling, capping a protracted negotiation with Republicans to avert a catastrophic default.

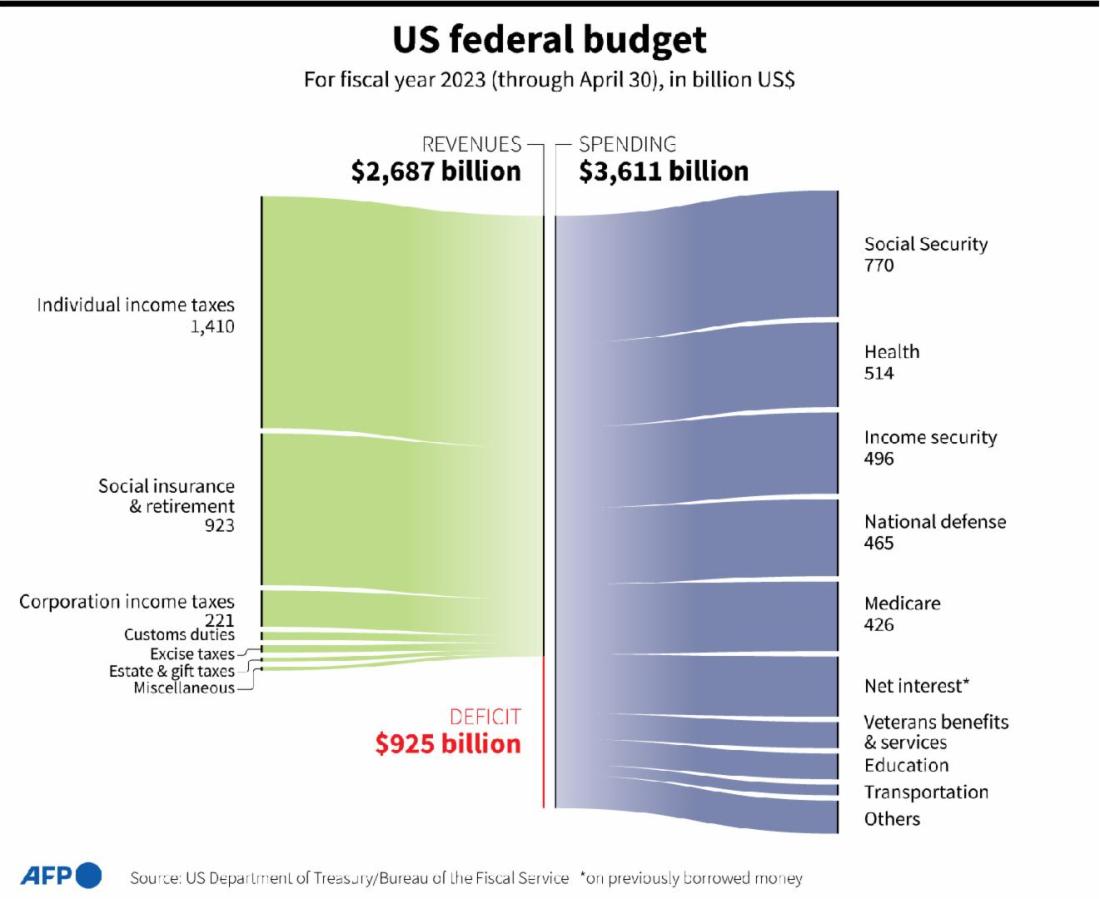

The national debt's gross total was around $33.6 trillion as of November 3 -- including some $7 trillion the federal government owes itself to cover expenses such as Social Security trust funds (archived here).

Biden has long blamed Trump, his chief opponent in the 2024 presidential election, for the ballooning debt.

"Under the previous administration, America's deficit went up four years in a row. Because of those record deficits, no president added more to the national debt in any four years than my predecessor," Biden said during his State of the Union address in February (archived here).

"Nearly 25 percent of the entire national debt, a debt that took 200 years to accumulate, was added by that administration alone."

Fact-checking outlets reported at the time that Biden's figures were correct. But independent experts told AFP coronavirus relief funding -- not tax cuts, as some online have claimed for months -- was responsible for most of the rise.

"The Trump tax cuts so far have cost $1-$1.5 trillion. Our debt held by the public is about $26.5 trillion," said Marc Goldwein, senior vice president and senior policy director at the Committee for a Responsible Federal Budget (CRFB), in a November 1 email.

"So, we're talking about maybe five percent of the debt."

How the tax cuts affected debt

Trump signed the Tax Cuts and Jobs Act (TCJA) in December 2017, greenlighting dramatic reductions for corporations and temporary discounts for individuals. Democrats branded the plan -- the first major legislative accomplishment of Trump's term -- as a giveaway to the wealthiest that risked blowing a hole in the national debt.

The Joint Committee on Taxation (JCT), a nonpartisan congressional committee that tasks professional economists, lawyers and accountants with conducting legislative research, estimated in 2017 that the law would cost roughly $1.5 trillion over 10 years by reducing revenues (archived here).

"The cost (of the TCJA) may turn out to be a bit higher, but nothing close to one-fourth of the $25 trillion national debt," said Eric Toder, a fellow at the Urban-Brookings Tax Policy Center at the Urban Institute, in a November 1 email.

"The 2017 legislation will slightly raise revenue after most individual income tax provisions expire at the end of 2025 but only, of course, if Congress does not extend these tax cuts."

If it does, CRFB, a group that promotes deficit reduction, estimates the extensions could cost "$3.3 trillion through 2033, or $3.8 trillion with interest" (archived here).

Why else did debt rise under Trump?

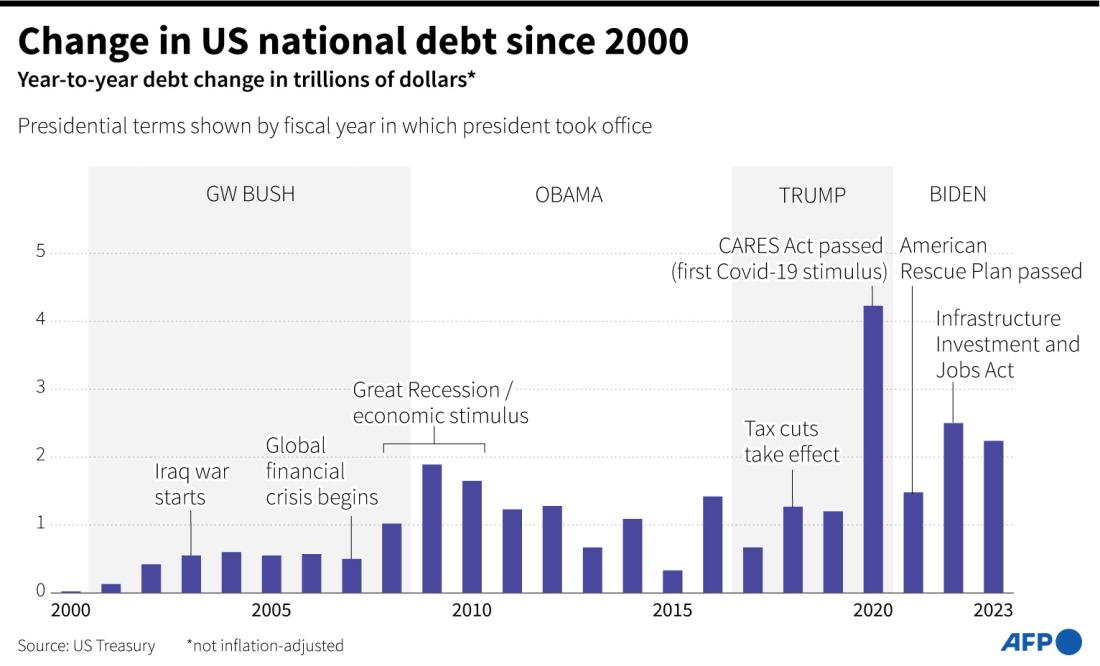

After Trump was elected, federal public debt rose by a record $7.7 trillion between late 2016 and late 2020, according to Treasury data (archived here).

"So, it is accurate to say that about 25 percent of the current debt was accrued during Trump's presidency," Toder said.

But tax cuts were not entirely to blame -- and Toder noted the United States was "running budget deficits when Trump assumed office, so not all the increased debt is attributable to new policies enacted during the Trump years."

"The biggest policy contributor during that period was from increased spending, especially in 2020 due to the pandemic," he said. "There were also tax cuts in 2020, but unlike the 2017 tax bill they were not concentrated among the highest-income households."

The Treasury Department offers a similar explanation on its website (archived here).

"One of the main causes of the jump in public debt can be attributed to increased funding of programs and services during the Covid-19 pandemic," the agency says.

Spending increased by 50 percent between the 2019 and 2021 fiscal years, according to the Treasury Department -- thanks largely to the Coronavirus Aid, Relief and Economic Security Act under Trump and the American Rescue Plan Act under Biden, both of which allocated trillions in emergency funding (archived here). The national debt rose by roughly $6.4 trillion over the same period, Treasury data show.

AFP has fact-checked other claims about US politics here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us