Social media posts mislead after Australia's central bank reports substantial losses

- This article is more than three years old.

- Published on September 28, 2022 at 11:38

- Updated on September 28, 2022 at 11:43

- 3 min read

- By Kate TAN, AFP Australia

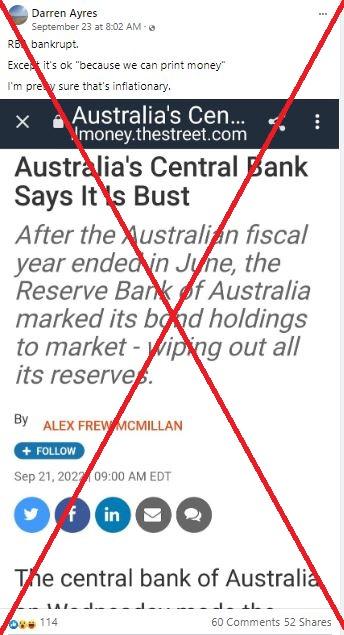

"RBA bankrupt. Except it's ok 'because we can print money'. I'm pretty sure that's inflationary," reads a Facebook post on September 23.

It includes a screenshot of a September 21 article headlined "Australia's Central Bank Says It Is Bust" published by RealMoney -- owned by US financial media outlet TheStreet.

In the article, it states: "After the Australian fiscal year ended in June, the Reserve Bank of Australia marked its bond holdings to market - wiping out all its reserves."

The claim circulated online after the RBA’s deputy governor Michele Bullock said on September 21 that following its Bond Purchase Program (BPP) review, the bank would report negative equity and a "substantial accounting loss" of Aus$36.7 billion (US$23.42 billion) in its 2021/22 annual accounts.

A similar claim was shared alongside the RealMoney article here and here.

Similar posts state the bank "admits it's technically bankrupted" and is "trading insolvent".

But the posts are misleading, financial experts said.

John Hawkins, a macroeconomics lecturer at the University of Canberra, told AFP there is no risk of RBA "going bust" or "going bankrupt" as its liabilities are guaranteed by the government.

Isaac Gross, an economics lecturer at Monash University, also told AFP: "The bank is still perfectly capable of operating even if it loses money on investments.

"Being able to print money at will means it can't go broke. But it is unlikely to provide the government with a dividend from its profits for several years."

Speaking on September 21, Bullock said that the bank's negative equity position would not affect its ability to operate or perform its policy functions, adding that it would return to positive earnings and equity over the next few years.

"Under the Reserve Bank Act, the government provides a guarantee against the liabilities of the Reserve Bank", she said. "Furthermore, since it has the ability to create money, the bank can continue to meet its obligations as they become due and so it is not insolvent."

Australia's Treasurer Jim Chalmers told journalists on September 21 that the government is not expected to be paid dividends from RBA this year.

"It's no surprise to us that there won’t be a dividend from the Reserve Bank this year given the pressures that they've been under and the decisions that they've taken," he said. "We weren't counting this year on a dividend from the Reserve Bank."

Bond prices

RBA’s bond-buying programme was introduced in November 2020 in response to the pandemic. The bank has purchased Australian, state and territory government bonds of Aus$281 billion (US$179 billion) according to Bullock's speech.

Experts told AFP that the bank is losing money because the bond price has decreased.

"Those bonds have fallen in value as the economy has recovered. If the RBA sold them today, they would make a loss," Gross said. "The RBA lost money by buying high and selling low – the opposite of traditional investment advice!"

Hawkins also said the loss is due to the recent rise in bond yields, which reduced the market value of RBA's bond that it bought during the pandemic.

"The [RBA] did not buy the bonds with the aim of profiting from them, but to help the economy recover from the Covid recession," he said. "Real GDP is now well above pre-Covid levels, and the unemployment rate is near a fifty-year low. So I would regard this as a policy success."

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us