Canadian retirees receive more pension money in 2021, not less

- This article is more than five years old.

- Published on January 13, 2021 at 15:49

- 1 min read

- By Alex CADIER, AFP Canada

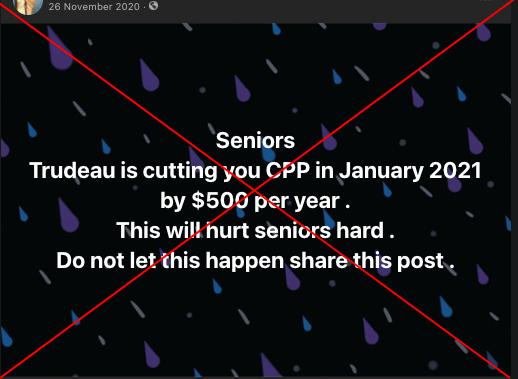

“Seniors, Trudeau is cutting you CPP in January 2021 by $500 per year,” claims the post, shared more than 83,000 times since November 2020.

Screenshot of a Facebook post taken on January 12, 2021

“This post made a false claim about CPP benefits,” a spokesman for the Minister of Seniors told AFP by email: “CPP is increased each year using the Consumer Price Index All-Items Index so that benefits are adjusted for the cost of living. Payments in 2021 will increase by one percent.”

Deb Schulte, Minister of Seniors, also rejected the claim on Facebook.

Screenshot of a Facebook post taken on January 13, 2021

By law CPP payments cannot be decreased.

According to the Canadian Government’s website, the “average monthly amount” of CPP income is $679.16, or $8,150 a year. If the claim in the post were true, it would represent a six-percent percent decrease.

Jason Heath, Managing Director of Objective Financial Planners in Toronto said via Twitter that the claim “is not true.”

“Canada Pension Plan (CPP) recipients have their pension adjusted once a year in January,” Heath explained. “For 2021, CPP pensioners will receive one percent more than 2020.

While this does not apply in Quebec, which has its own pension plan, 2021 payments to seniors also increased in the province.

Changes to Canada Pension Plan contributions

The post may have confused an increase in the amount Canadian workers are required to pay into the Canadian Pension Plan this year with benefits paid to pensioners.

A plan introduced by the Liberal government in 2016 set CPP contributions to gradually increase each year starting in 2019.

The increase could not be delayed despite the Covid-19 pandemic’s toll on the Canadian economy.

“I believe this to be mistaken with the rise in CPP contributions and not seniors receiving the CPP benefit,” Marlene Buxton a retirement income specialist who runs Buxton Financial in Toronto, said by email

“The changes that have come about are to do with the contributions to CPP which means, individuals that are working and contributing to the CPP. It works out to about $275/year increase in contributions to someone working as an employee and about $551/year for someone self-employed.”

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us