No, Kenyans haven’t been ordered to stop repaying loans from mobile lending apps

- This article is more than six years old.

- Published on July 18, 2019 at 12:19

- 2 min read

- By AFP Kenya, Mary KULUNDU

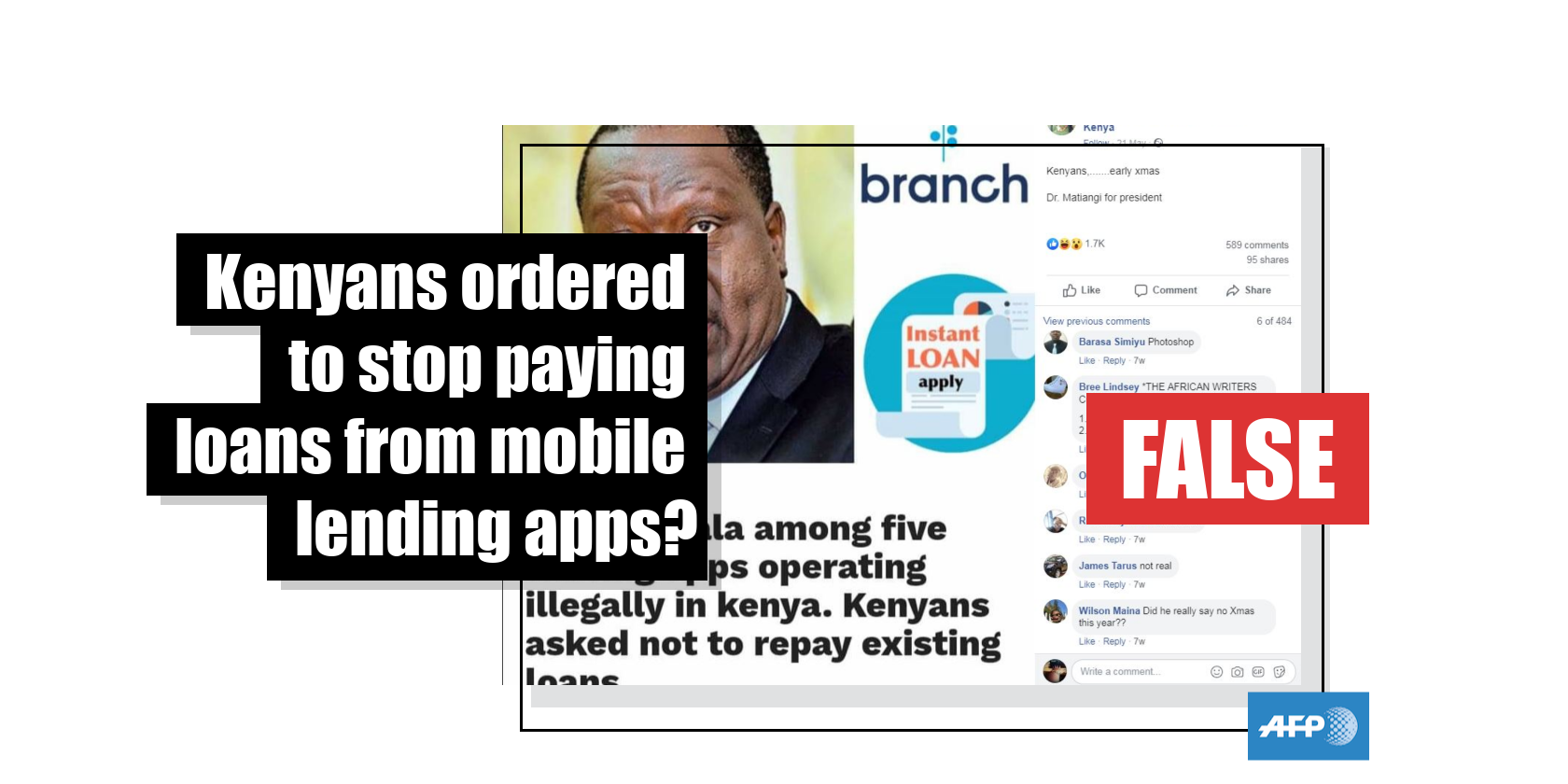

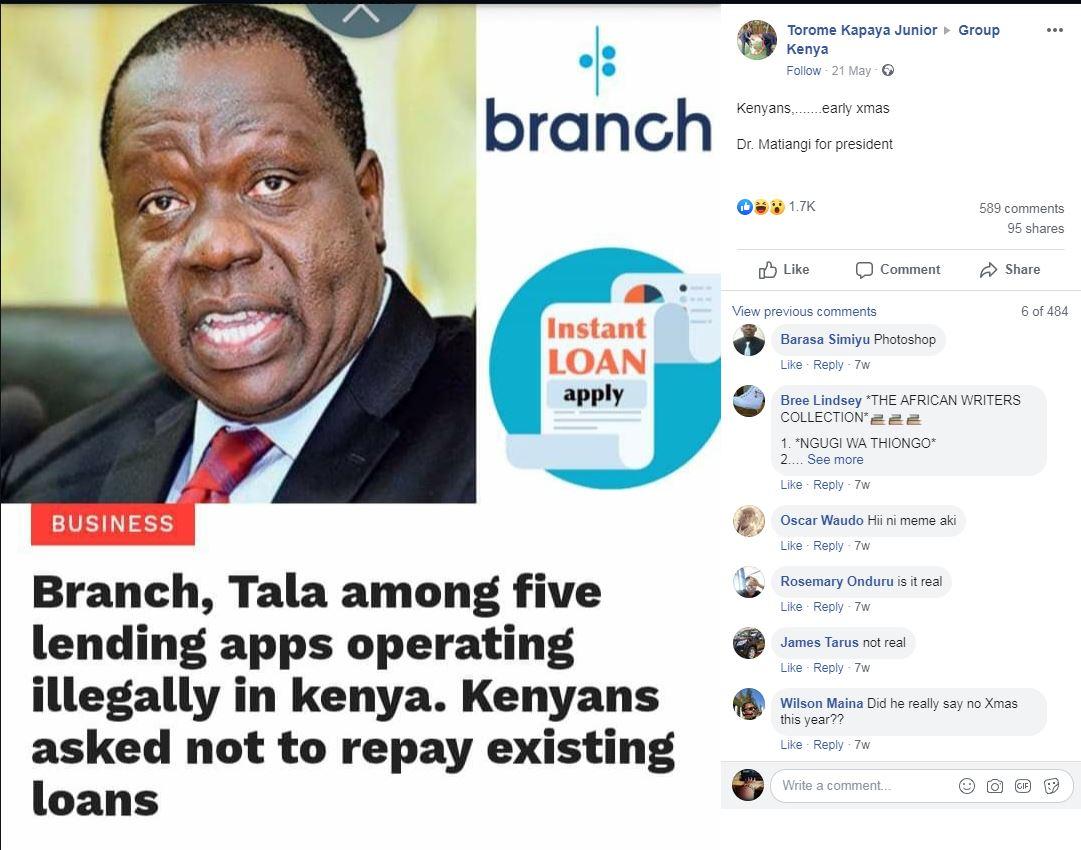

An article published on the website hivipunde.com, which we’ve archived here, claimed Matiang’i had asked Kenyans not to repay loans to five companies -- Branch, Tala, Opesa, Okash and Zenka -- “as they operate illegally in the country”.

“We are urging the public not to clear the existing loans until a case is determined on how the Mobile lending apps acquired licences to operate. We are doing everything humanly possible to ensure that all business operations in the country follow the law," the website quoted Matiang’i as saying.

According to social media analysis tool CrowdTangle, the article was shared more than 150 times. Other articles with similar claims were published here and here.

In fact, it’s a screenshot of the headline from that final article -- published on the website Butwaa.com -- that appears to be circulating most widely.

It was posted on numerous Facebook pages, including Group Kenya, a public Facebook group with more than two million members. The post was shared more than 90 times, accruing more than 2000 comments and reactions.

“Kenyans,.......early xmas. Dr. Matiangi for president, “ the caption on the May 21, 2019 post reads.

We’ve archived a few other Facebook posts that shared the screenshot of the article here, here and here.

Some online users appeared pleased by the supposed order from Matiang’i to halt their loan repayments, while others questioned whether the article was accurate.

But Wangui Muchiri, spokeswoman for Matiang’i’s ministry, said he had made no such order.

She told AFP via WhatsApp message that she was “unaware of such pronouncement or action” by the minister.

The central bank wants mobile lending apps to be regulated

The Central Bank of Kenya (CBK) has been pushing for the regulation of mobile lending services, accusing them of charging Kenyans exorbitant interest rates. Tala, for instance, charges 15-percent interest on a 30-day loan, and 11 percent on 21-day loans.

As reported by local media last week, CBK governor Patrick Njoroge singled out three such apps -- Tala, Branch and Okash -- while giving evidence to a parliamentary committee, saying they could easily be used to launder illicit cash.

In July 2018, the CBK, the ministry of trade and four other institutions issued a statement warning Kenyans of the emergence of unlicensed and unregulated financial services and products available online.

But there has been no instruction from the government for Kenyans to stop paying off loans they have already taken out via mobile lending apps.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us