No, Kenyans are not being arrested for defaulting on their loans

- This article is more than six years old.

- Published on July 10, 2019 at 16:37

- 4 min read

- By AFP Kenya, Mary KULUNDU

The post, which we’ve archived here, was shared in Group Kenya, a public Facebook group with more than two million members.

It shared the two photos of people in police custody, alongside a caption which read: “BREAKING NEWS!!!! 12 people have been arrested after failing to pay Tala, Branch and fuliza loans, ukipigiwa simu Usichukue !!! Wako pangani, ndo wanaingia Nairobi (When they call you, do not pick up! They are in the Pangani area heading to the Nairobi central business district),” the caption reads.

The post has been shared more than 400 times since it was posted on June 18, 2019, and has attracted more than 7,000 comments and reactions.

Tala, Fuliza and Branch are all online services that allow people to borrow money using their mobile phones. If the post was to be believed, customers unable to pay their loans back were being rounded up by police, as seen in the photos.

However, a reverse image search shows that the images were in fact taken at different crime scenes, years apart.

Using TinEye, a reverse image search engine, we were able to trace previous times when the photo of the woman, covering her face with her striped top, has appeared online.

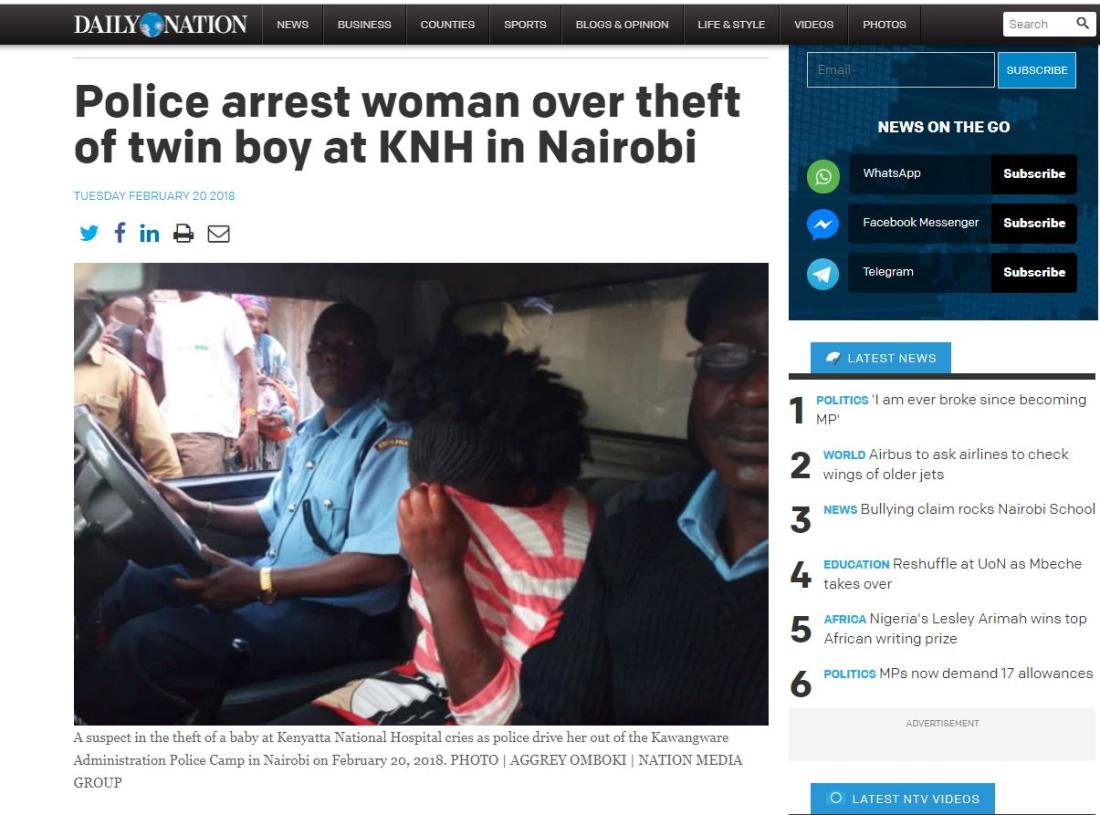

This search revealed that the photo, taken by Aggrey Omboki for the Nation Media Group in February 2018, showed a suspect in the theft of a baby from Kenyatta National Hospital. You can read the Daily Nation’s report on the case here.

Other media, including Capital FM and the Standard, used different photos in their reports about the case, also showing a woman wearing the same striped top. So it’s clear that the photo relates to the 2018 baby-stealing case and does not show a woman being arrested for defaulting on her loan.

Our reverse image search also revealed that the same photo was used by the website Kenyans.co.ke in a May 2019 article, archived here, about a woman arrested in connection with a series of audacious break-ins. The caption reads only “Police officers pictured after taking a woman into custody”, and readers might easily conclude that the photo shows the suspect Margret Waithira Kamande. But again, the photo relates to a completely separate earlier case.

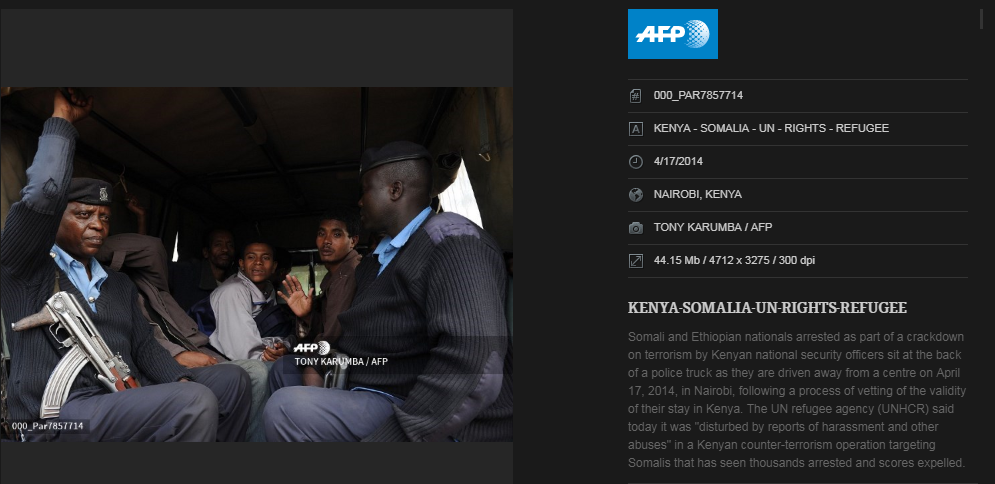

As for the second picture used in the false Facebook post, a reverse image search on TinEye revealed that it was actuallly taken by AFP photographer Tony Karumba in April 2014, after Somali and Ethiopian nationals were arrested during an anti-terrorism operation.

It can be found here on the AFP Forum website.

Defaulting on a loan is not a criminal offence in Kenya

Under Kenya’s banking laws, lending institutions have the option of conducting a recovery once a borrower defaults -- but defaulting is not a criminal offence.

“An institution shall be limited in what it may recover from a debtor with respect to a non-performing loan to the maximum amount of: the principal owing when the loan becomes non-performing; interest, in accordance with the contract between the debtor and the institution, not exceeding the principal owing when the loan becomes nonperforming; and expenses incurred in the recovery of any amounts owed by the debtor,” the Banking Act states.

Chris Karanja, a communication official at Safaricom -- the telecoms company which owns Fuliza -- told AFP that no client had been arrested for defaulting on a payment of a Fuliza loan.

“Should you delay repaying your Fuliza, you will get reminders for 90 days, after which you will be listed on CRB (credit reference bureaus -- entities which keep track of people’s credit performance). The delisting process is initiated once a customer makes a repayment. Defaulting on a loan is not a criminal offence and therefore one cannot be arrested for this,” Karanja said in an email.

Kevin Kaburu from Tala, another app mentioned in the false Facebook post, told AFP that there is a grace period after a customer defaults on a loan. After that, Tala’s collection unit enters into a conversation with the borrower to establish how the repayment can be made.

“The post is false and inaccurate. Loan defaulters, post the grace period and the late penalty fee period, move into our collections unit who engage in conversations with the customer with the view to help in the repayment. We do also submit names to Credit Reference Bureau for the defaulters,” Kaburu said in an email.

We have also reached out to the third company named in the false posts, Branch, for comment but have yet to hear back.

However, the claim that Kenyans are being arrested for defaulting on loans with these three companies can be dismissed as false.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us