Posts claiming Mali is the first debt-free country in Africa are false

- This article is more than one year old.

- Published on December 10, 2024 at 13:59

- 4 min read

- By Monique NGO MAYAG, AFP Senegal

- Translation and adaptation Oluseyi AWOJULUGBE, AFP Nigeria

“Mali is now a debt-free country,” reads a post shared more than 7,000 times on X since November 10, 2024.

Posts here and here made similar claims, adding that Mali was the first African country to pay off its debt. French-speaking internet users also shared these claims on Facebook and YouTube.

Many comments praised Mali’s military leadership for the purported financial turnaround.

“Nigerian military wake up, Nigerians needs you all,” a Facebook user commented, suggesting a military takeover would benefit the country.

But others were less positive.

“Funny enough, the high-ranking soldiers that will make it happen as it happened in Mali are absolutely corrupt,” wrote a user in Nigeria.

However, the claims circulating about Mali settling its debt are false.

Over 6.5bn FCFA debt

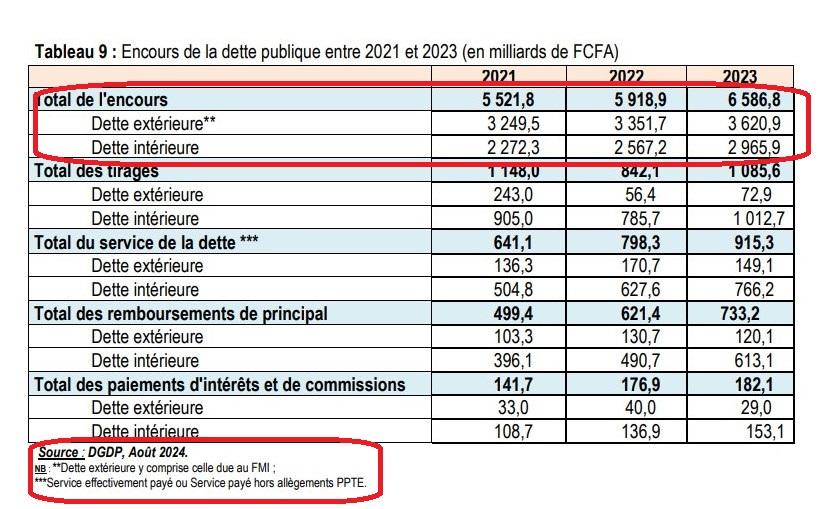

The real debt figures are in Mali’s 2025 finance bill, the official French-language document that sets out the expenditure and revenue forecasts used to draw up the country’s budget.

The Council of Ministers adopted the bill on September 18, 2024.

Several segments of the document include data on the amount of Mali’s debt, showing that it is far from being paid up (archived here).

For example, page 347 states, "the stock of Mali’s public debt at the end of 2023 (was) estimated at FCFA 6.5 billion”.

Furthermore, on page 409, the “total outstanding” public debt is estimated to “amount to CFAF 6,731.6 billion” (about $11.18 billion) by December 31, 2024.

This total comprises a domestic debt of 3,813.0 billion CFA francs (or 56.6 percent of the debt) and external debt of 2,918.6 billion CFA francs (or 43.4 percent of the debt).

The comparison of the total debt versus the wealth produced each year by a country, better known as GDP, is often more meaningful when analysing the debt ratio.

This figure is also available in Mali’s 2025 finance bill on page 347. In 2023, public debt represented almost 50.9 percent of the country’s GDP. This year, the debt ratio was expected to increase slightly to 51.6 percent of GDP, before falling to 50.6 percent in 2025.

Impending large repayments

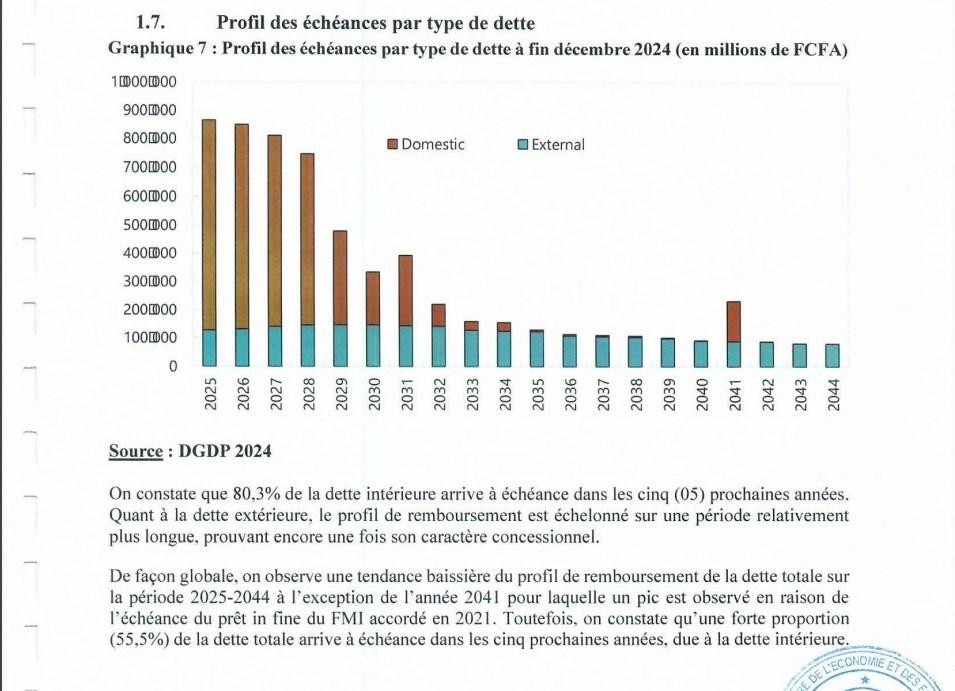

A table published on page 413 of the bill shows that Mali's debts currently run until 2044.

In 2025 alone, Mali estimates it will spend 918.4 billion CFA francs to repay some of its domestic debt.

The bill also shows that the country will have to pay off a large part (80 percent) of its domestic debt in five years.

“The Malian government is accumulating substantial arrears on its domestic debt, which is a very bad indicator,” notes Emilie Laffiteau, an economist specialising in sub-Saharan Africa.

“These delays are seriously damaging the local economy, particularly by weakening the private sector,” she told AFP Fact Check, adding that “prioritising the repayment of domestic debt is essential to relaunching the national economy”.

In a national broadcast on October 18, economy minister Alousséni Sanou pledged to release 200 billion CFA francs by the end of the current year to settle its domestic debt (archived here, from 17'44").

“We intend to commit around 200 billion CFA francs to achieve a very significant and exceptional reduction in the level of domestic debt,” he told business leaders during a meeting in Mali.

New geopolitical reality

Mali has found itself in a new geopolitical context since the 2021 coup.

The country's military rulers, like the regimes in neighbouring Burkina Faso and Niger, have chosen to turn their backs on the Economic Community of West African States (ECOWAS), an organisation they consider to have been manipulated by France, the former colonial power with which they have repeatedly broken ranks (archived here).

Claiming that “Mali is debt-free” promotes “a common sovereignist discourse according to which ‘the country doesn’t need anyone’,” explained Laffiteau. “But this does not reflect a solid economic reality.”

Furthermore, a country without any debt “would be a disaster” because “public debt is a fundamental tool for financing development and the necessary investments”, Laffiteau added.

“On the contrary, being able to attract external financing is a key indicator of good economic health.”

She believes, however, that Mali – whose external debt is mainly held by international bodies (the World Bank via the IDA at 49 percent and the African Development Fund at 16.3 percent) — is finding it difficult to obtain financing from international banks“because they do not have confidence in the country”.

Why debt matters

According to Malian economist Modibo Makalou, Mali’s public debt “essentially finances the budget deficit” of the government in the face of the “cyclical” and “structural” challenges that have hit the country.

The nation has gone through a serious energy crisis and has suffered from the “increase in interest rates” applied by the Central Bank of West African States (BCEAO) “to combat inflation,” he explained.

The debt has been used to pay off “the state’s operating and investment budget”, as well as to finance “development projects”, Makalou said, echoing Laffiteau’s comments about the benefits of having recourse to debt, as long as it does not reach excessively high levels.

In 2025, Mali’s debt burden (interest and capital) is projected to be 214.5 billion CFA francs, 80 percent of which is linked to domestic debt.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us