Canada's open banking plan stokes unfounded 'social credit' claims

- This article is more than one year old.

- Published on March 21, 2024 at 18:12

- 4 min read

- By Gwen Roley, AFP Canada

"The wholly captured and penetrated technocommunist nation of Canada is leading the way in implementing the dystopian social credit score system," says the text of a March 19, 2024 Substack post.

Screenshots and links to the blog were shared on X, where similar claims about an imminent social score system in Canada proliferated while also being shared on Facebook, Instagram and TikTok in English and French.

Armstrong Economics -- which has previously shared misinformation fact-checked by AFP -- appears to be one of the earliest publishers of the claim, purporting in a March 14 blog post that Canada's anticipated framework for an open banking system would provide information to determine "if a person is fit to participate in the global economy based on their personal views."

These claims were the latest to warn that social credit scores are on the cusp of being adopted in their jurisdiction, often referencing periodic stories from China about systems that enforce standards by deterring or rewarding certain behaviors.

China's system has raised concerns around the world about governments deploying technology to step up surveillance, including through the monitoring of financial transactions.

Federal Canadian intelligence, immigration and trade departments have penned reports on social credit scores in China (archived here, here and here), but the Department of Finance Canada told AFP there are no plans to adopt such a system.

"Any allegation that the Government of Canada is trying to introduce social credit scores is categorically false," the department said in a March 20 email.

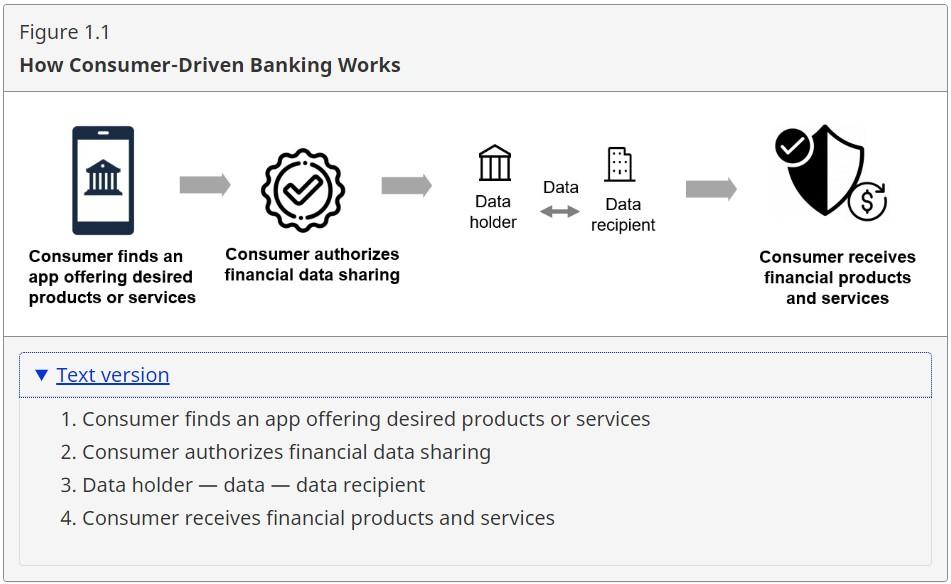

Marc-André Pigeon, an assistant professor at the Johnson Shoyama Graduate School of Public Policy at the University of Saskatchewan (archived here), said open banking has nothing to do with tracking personal views as claimed in the posts. Rather, the system refers to a framework that governments adopt to securely facilitate the flow of financial information between banking institutions and third-party applications, such as budgeting and wealth management tools.

How open banking works

Open banking, or consumer-driven banking (archived here), is not yet available in Canada. According to the Department of Finance Canada website (archived here), the federal government will submit framework legislation for open banking to be introduced in 2025 with the next budget (archived here). It is aimed at making it easier for consumers to link their accounts with apps for financial management without having to input passwords, which can pose security risks.

"An estimated 9 million Canadians currently share their financial data by providing confidential banking credentials to service providers," the Department of Finance says. "This process, known as screen-scraping, is unsecure and raises security, liability, and privacy risks to consumers and the financial system."

Countries including Australia and the United Kingdom (archived here and here) have already adopted open banking frameworks.

Pigeon said open banking "is meant to make the sharing of data and ultimately the automation of transactions, safe and secure with clear attributions of liability, clear notions of consent, and clear protection from kind of cybersecurity threats and hacking that we don't have absent of that policy framework."

He also noted that the system in Canada would be opt-in and users would have to consent to share information.

The claim from Armstrong Economics that open banking would lead to social credit scores hinged on a phrase from a Canadian Press article covering the anticipated new framework which said lenders could look "beyond credit scores" that assess customers' financial health.

Pigeon said that under an open banking system, a financial institution would have access to information outside of the calculated credit score and be able to use data points such as transaction data -- with permission -- to assess lending risk.

"So, they'll have a richer picture of what kind of person you are from a transaction-debt-payment perspective, and how much they should charge you for your loan," he said.

He explained that open banking would not change the level of access the government has to financial data -- unless a citizen is applying for a government loan and chooses to share their information.

Privacy in banking

Some users spreading the claim said the government wanted more surveillance powers and alluded to the freezing of protesters' bank accounts during the 2022 trucker convoy in Ottawa, by invoking the Emergencies Act (archived here).

In January 2024, a federal court ruled the use of the law was an overreach, but the government said it would appeal the decision.

Robbie Grant, a privacy lawyer at McMillan LLP in Toronto, said the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (archived here) requires banks to report and monitor suspicious activity to the government.

He said open banking would not change the amount of information currently available to the government, nor would users be required to present more personal data.

"There's no indication that banks would have any more access to your information through the open banking framework," he told AFP on March 19.

Read more of AFP's reporting on misinformation in Canada here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us