Australia's Commonwealth Bank says no plans to scrap ATMs

- This article is more than one year old.

- Published on March 18, 2024 at 05:30

- Updated on March 18, 2024 at 06:00

- 2 min read

- By Kate TAN, AFP Australia

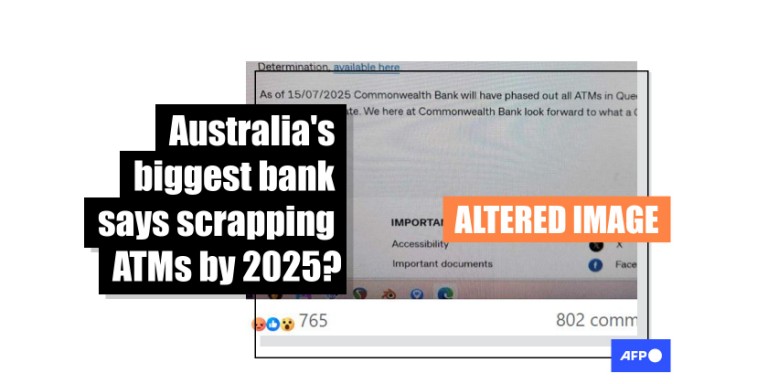

"Com bank (Commonwealth Bank of Australia) going cashless," reads a Facebook post sharing the fabricated screenshot.

The post, which was published on March 6, attracted more than 800 shares before it was deleted.

It appears to show a screenshot from the CBA website that says: "As of 15/07/2025 Commonwealth Bank will have phased out all ATMs in Queensland, with other states to follow at a later date."

"We here at Commonwealth Bank look forward to what a Cashless Society will bring to Australia."

Similar Facebook posts garnered more than 10,000 shares, including here, here and here.

The posts surfaced after CBA subsidiary Bankwest announced on March 6 it would shut all branches in Western Australia in a push towards online banking services.

Bankwest said in a statement the move was influenced by "rapidly changing customer preferences", claiming 97 percent of its transactions were done digitally and less than two percent of customers regularly visited a branch. (archived link).

It added that customers could use CBA ATMs and cash services would continue at post offices in Western Australia.

However, some Facebook users appeared to believe CBA had announced it would scrap cash machines by 2025.

"Just so wrong. Needless to say all the other banks will follow. Now we can't even decide how we obtain our own money. Shameful!" one comment read.

Another said: "It's legit the way the government are going to take full control of us."

While local media reported in February 2024 that CBA had removed more than half its ATMs in the past five years, a representative from the bank said the screenshot circulating on Facebook was "fake" (archived link).

A keyword search of the CBA's website also found no mention of the wording in the purported statement.

'Fake content'

"While we're investing in our digital services where the majority of customers are engaging with us, we know access to cash remains important and we certainly have no plans to phase out ATMs or stop providing cash," the CBA spokeswoman told AFP on March 12.

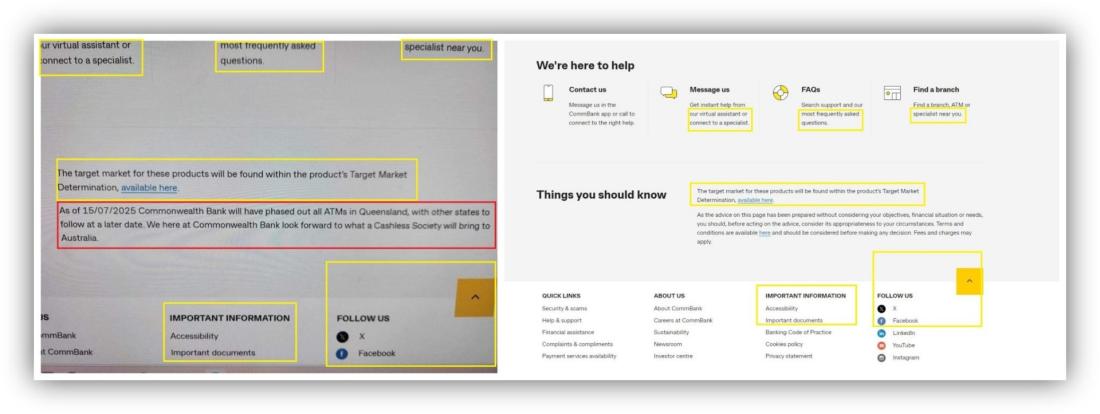

She said the screenshot showed part of a standard footer on CBA web pages, like the one on its Banking page, but that the financial disclaimer from the page was "removed and replaced with fake content" (archived link).

She added that the fake content appeared to replace the original note, which read: "As the advice on this page has been prepared without considering your objectives, financial situation or needs, you should, before acting on the advice, consider its appropriateness to your circumstances. Terms and conditions are available here and should be considered before making any decision. Fees and charges may apply."

Below is a screenshot comparison of the doctored statement (left) and an authentic CBA page (right), with identical features highlighted in yellow and false content highlighted in red by AFP:

Meanwhile, CBA's official account on social media platform X replied to users who shared the purported screenshot here, here and here pointing out the information and screenshot was "fake" (archived links here, here and here).

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us