'Tax changes' falsely blamed for pay cuts that sparked deadly Papua New Guinea riots

- This article is more than one year old.

- Published on March 14, 2024 at 08:26

- 3 min read

- By Joseph OLBRYCHT PALMER, AFP Australia

At least 25 people died in riots that gripped Papua New Guinea in January, triggered when members of the country's police force went on strike after their pay was docked without explanation.

Although the government swiftly promised to fix what it described as a payroll "glitch", it was not enough to stop disgruntled civilians from joining the fray (archived link).

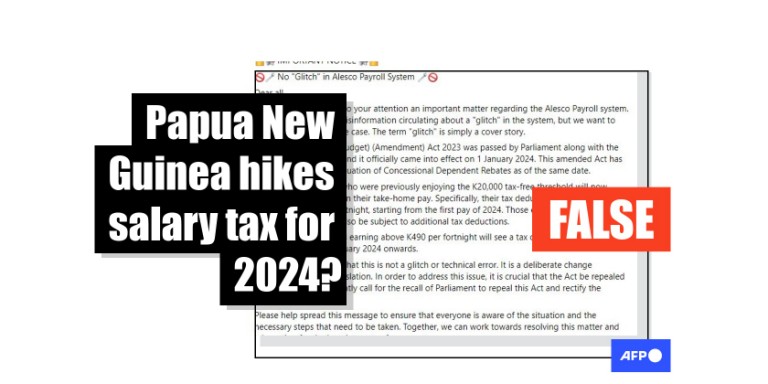

In the days after the riots, a torrent of posts emerged on social media signed off by a supposed "Alesco Payroll Analyst" -- referring to the payroll service firm implicated in the pay issue.

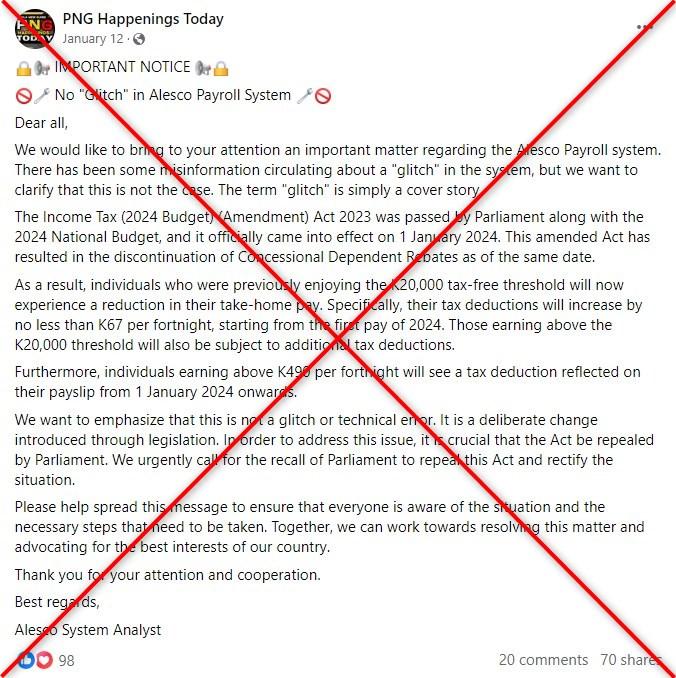

"The Income Tax (2024 Budget) (Amendment) Act 2023 was passed by Parliament along with the 2024 National Budget, and it officially came into effect on 1 January 2024," said one Facebook post shared on January 12.

"As a result, individuals who were previously enjoying the K20,000 ($5,300) tax-free threshold will now experience a reduction in their take-home pay," it claimed.

The post added tax credits called "concessional dependent rebates" were also discontinued. It proceeded to show purported salary cut calculations.

"We want to emphasize that this is not a glitch or technical error. It is a deliberate change introduced through legislation. In order to address this issue, it is crucial that the Act be repealed by Parliament."

Similar posts blaming an amendment to Papua New Guinea's tax law for the pay cuts were also shared elsewhere on Facebook here, here and here, and on LinkedIn here and here.

But a review of the country's national budget and other government documents found the salary tax structure remained the same from the previous year.

No tax increase

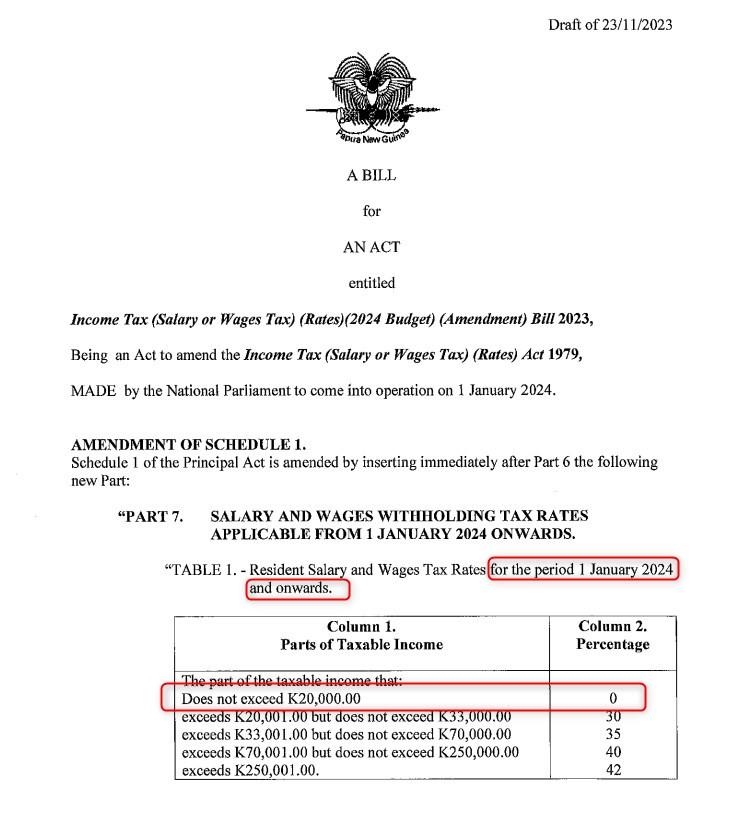

The salary tax structure for the year 2024 is found on page 32 of Papua New Guinea's national budget document. The document was uploaded by the treasury department here (archived link).

As shown in the screenshot below, residents with salaries that do not exceed K20,000 remained tax-exempt "for the period 1 January 2024 and onwards", contrary to the false posts.

The same tax-free threshold applied in 2023 as indicated in earlier government publications here and here (archived links here and here).

A report from consultancy giant PricewaterhouseCoopers described recent changes in Papua new Guinea's taxation as "ultimately limited" (archived link).

It indicated the tax-free threshold had been "retained on a permanent basis" at K20,000. This level was meant to be a temporary cost of living support measure, the report said.

"The only amendment to tax laws was the extension of the raising of the tax-free threshold to K20,000 which was initially only intended for implementation in 2023," Maholopa Laveil, an economics lecturer at the University of Papua New Guinea, similarly told AFP.

Tax rebate

Posts circulating online also claimed Papua New Guinea salaries were cut in January when "concessional dependent rebates" -- a form of tax credit -- were discontinued.

While the government intended to remove the tax rebate, the measure could not have caused the pay cuts as it was not yet in effect, internal revenue chief Sam Koim said.

"The amendment for the removal of the dependants' rebate was passed in last year's budget but that law has not been gazetted and hence HAS NOT COME INTO EFFECT," he said in a note published on January 11 (archived link).

"We reiterate that what has started this protest and chaos was not a result of effecting the dependants rebate removal but a failure to reconfigure the Alesco system."

Koim said the finance department was already working to "reimburse the salaries lost on Pay 1 of 2024".

In a separate statement dated January 19, he announced that following the riots, the government decided to "put on hold the implementation of the dependant rebate repeal" (archived links).

"The dependant rebate calculations are to therefore continue to apply," he said.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us