Users falsely claim Australian bank will close customers' accounts over social media posts

- This article is more than two years old.

- Published on December 19, 2023 at 03:29

- 3 min read

- By Kate TAN, AFP Australia

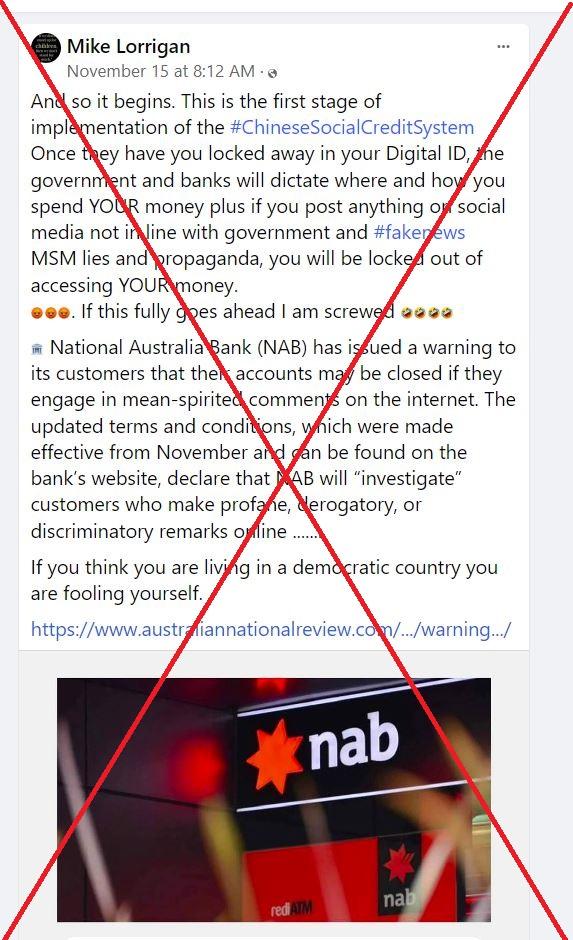

"If you post anything on social media not in line with government and #fakenews MSM lies and propaganda, you will be locked out of accessing YOUR money," reads a Facebook post from November 15, 2023 using the abbreviation "MSM" for mainstream media.

It cites an August 30 article by a website called Australian National Review -- which has published false information debunked by AFP before -- saying the bank is targeting "mean-spirited comments on the internet".

That was followed by an article making a similar claim on The People's Voice website, which has also previously spread misinformation debunked by AFP.

"If an NAB customer says something that goes against the mainstream narrative, the bank will take away his or her bank account as punishment," the article says.

The posts surfaced after NAB implemented a new policy in November to tackle financial abuse -- where a person's ability to earn, use or maintain money is restricted by a partner or a family member.

The initiative was announced in June and the bank said it would "suspend, cancel or deny individuals access to their savings and transaction accounts if the bank identifies them as engaging in financial abuse" (archived link).

A survey released in November 2023 by the Australian Bureau of Statistics found 7.8 percent of men and 16 percent of women surveyed said they had been the subject of financial abuse by their partners.

Other Australian banks, including ANZ, the Commonwealth Bank of Australia and Westpac, have taken similar measures to crack down on financial abuse.

The false claim was also shared on Facebook here, here and here.

However, the claim is false. AFP has reviewed NAB's new terms and conditions and found it does not contain references to the bank's ability to close a person's bank account based on social media posts.

A spokesperson for the NAB has told AFP that its terms and conditions do not apply to customer behaviour outside of NAB banking channels, including social media.

Financial abuse

The bank's updated terms and conditions list situations where it may investigate an account or a service that is being used in a financially abusive manner (archived link).

It allows the bank to suspend, cancel or deny an account holder's access or use of an account if the bank considers it "appropriate to protect a customer or another person from financial abuse".

A spokesperson for NAB also told AFP on December 8 that its terms and conditions "do not apply to customer behaviour outside of NAB banking channels".

The bank has since updated the statement released in June to specify the new measures only covered abusive messages sent via payment transfers, and did not include statements made on social media (archived link).

Several other major Australian banks, including ANZ, the Commonwealth Bank and Westpac, also have similar clauses in their terms and conditions that allow the bank to close accounts or block access to accounts if they have been used to engage in financial abuse (archived links here, here and here).

Catherine Fitzpatrick, an adjunct associate professor with the School of Social Sciences at the University of New South Wales, has told AFP that these measures are "specifically aimed at preventing the misuse of bank products and services. They do not reference social media."

She published a paper in 2022 on how the Australian finance sector could tackle abuse by changing the designs of its products and services (archived link).

Fitzpatrick went on to say some customers used payment systems to abuse people as a last resort after being blocked from other platforms.

"A perpetrator may use transaction descriptions to send unwanted, threatening or abusive messages. This is substantially different from expressing an opinion on a social media platform," she said.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us