Canada’s carbon tax: Misleading claims fail to mention rebates

- This article is more than six years old.

- Published on June 20, 2019 at 16:28

- 4 min read

- By Manuela SCALICI

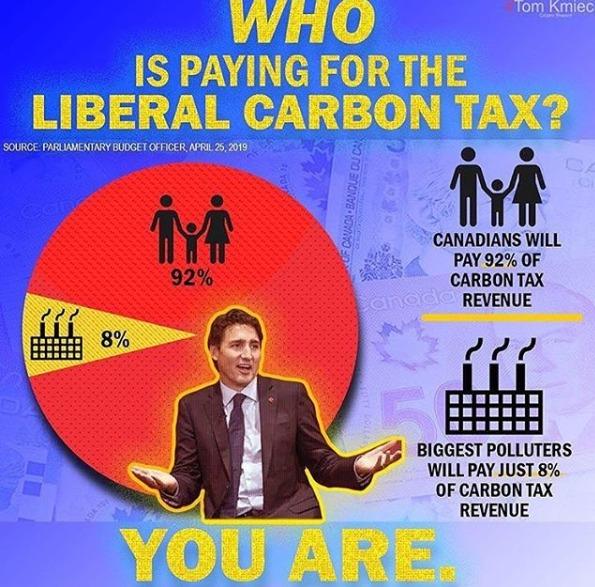

An Instagram post with almost 1,500 likes shows a pie chart illustrating how “Canadians will pay 92% of carbon tax revenue” while the “biggest polluters,” or large, carbon-emitting industries, “will pay just 8% of carbon tax revenue.” This information was initially communicated by Ed Fast, Conservative Shadow Minister for Environment and Climate Change in a statement. It was also shared in numerous tweets such as this one by Conservative party leader Andrew Scheer and other MPs.

The claim was also found on Facebook, archived here.

Where do the numbers come from?

The posts source the figures to a report from April 2019 by the Office of the Parliamentary Budget Officer (PBO) analyzing the carbon tax. The ‘Executive Summary’ on the first page of the report says $2.43 billion in tax will come from fuel charges that affect households, and $197 million will be from the output-based pricing system that affects large industries. The percentages in the misleading posts are based on these numbers. However, the report states: “This analysis is based on gross amounts, that is, prior to any transfers back to households.” The numbers were calculated prior to the Climate Action Incentive Payments.

The PBO’s report clearly states: “Households will receive 90 per cent of the revenues raised from fuel charges. Based on this assumption, a typical household will receive higher transfers than the average amounts it pays in fuel charges.”

University of Calgary economist Trevor Tombe told AFP that the post is misleading “primarily because for households it ignores the rebates that are meant to cushion the blow. But for large emitters they count the subsidies that are embedded in the large emitter program.”

What do we know?

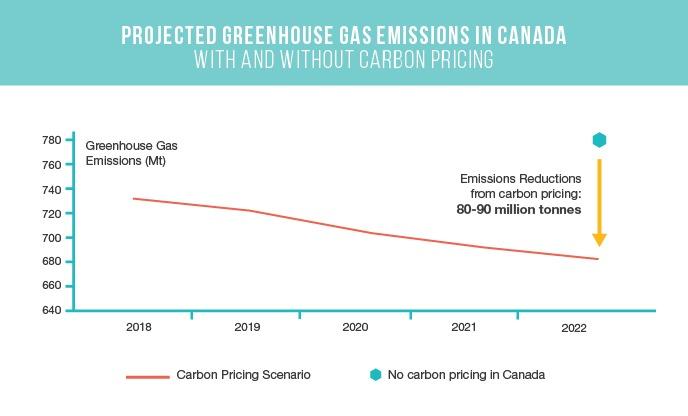

The federal carbon tax was enacted on April 1, 2019, by Prime Minister Justin Trudeau’s Liberal government and is currently set at $20 per tonne of CO2 emitted. The tax is part of a federal plan to reduce 30 percent of Canada’s emissions by 2030, to meet its obligations to the Paris Agreement signed in 2015. Canada ranks as one of the top ten carbon emitters in the world.

The federal carbon tax took effect in four provinces: Ontario, Saskatchewan, Manitoba and New Brunswick, because their pre-existing policies did not meet the benchmark to reduce emissions. It will also be enacted in Alberta in 2020 after the new provincial government abolished its provincial tax.

The federal carbon tax is made up of two main elements: a carbon levy and an output-based pricing system (OBPS). The carbon levy is a charge on fossil fuels, referred to as a “fuel charge.” The fuel charge directly affects households through electricity, heating powered by fuels and private transport using motor fuels.

The OBPS affects industrial facilities by taxing emissions above a certain threshold. Facilities whose emissions exceed the limit can pay the carbon price directly or use surplus or offset credits. This website explains that the Government of Canada issues surplus credits to facilities whose emissions fall below their annual limit. Offset credits can be bought from low-emitting industries.

The federal government recycles some of the revenue raised from large emitters back to those facilities through output-based allocations. Tombe said: “That means the net revenue from the large emitters is actually quite small.”

According to Canada’s Ecofiscal Commission, the output-based allocations help emission-intensive industries which could lose business to international competitors if they raised prices to pay the carbon tax.

Jennifer Gearey, a spokesperson for Environment and Climate Change Canada, confirmed that the “multiple compliance options” for large industries, like surplus credits and eligible offset credits “makes the actual amount of proceeds generated difficult to predict.”

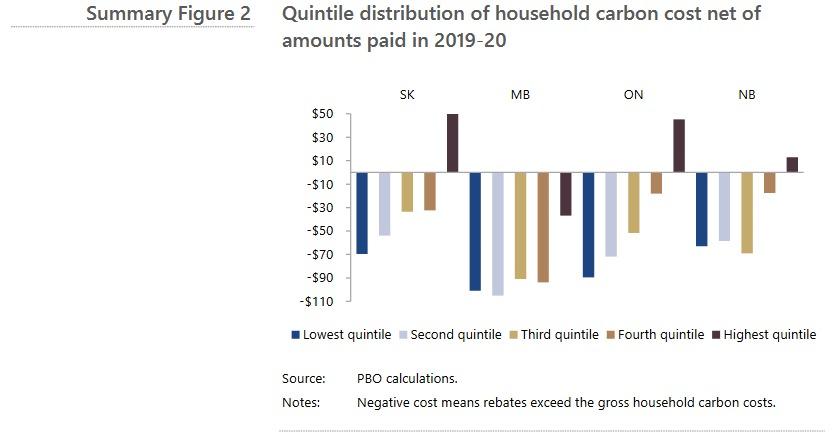

Tombe told AFP that the household rebates are uniform: every household in the same province will receive the same amount. Households who reduce their use of fuel may profit from the rebates, which is what the policy hopes to achieve. The PBO explained how the rebates benefit lower income households that consume less fuel with smaller homes and fewer cars. According to the report, only the richest fifth of the population will pay more in carbon taxes than they receive in rebates.

Rebates have not yet met the prediction of $2.1 billion. Etienne Biram, spokesperson for the Canada Revenue Agency told AFP “eligible individuals and families have claimed about $1.75 billion in Climate Action Incentive payments.” However, this is not a final number as people are still filing their taxes.

What can be concluded?

The claim that Canadian households will pay for 92 percent of the carbon tax is misleading. The posts isolate information from the first page of the PBO report without explaining the details of the rebate scheme.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us