Sanders is not proposing a 52-percent tax on minimum-wage incomes

- This article is more than six years old.

- Published on February 27, 2020 at 19:04

- 1 min read

- By W.G. DUNLOP, AFP USA

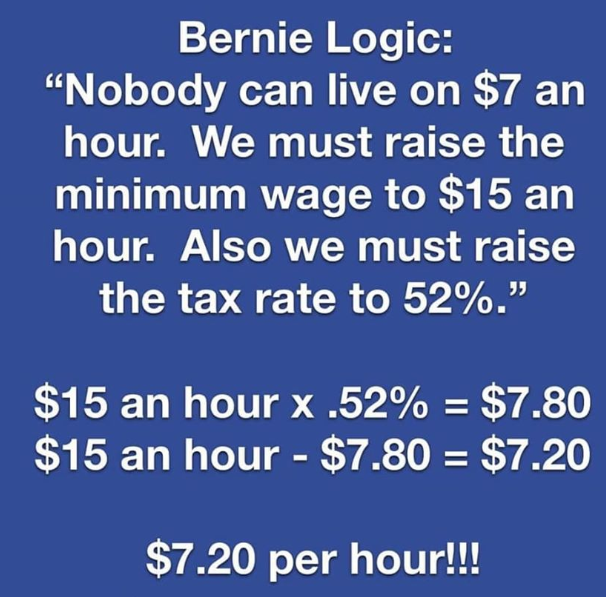

“Bernie’s Logic: ‘Nobody can live on $7 an hour. We must raise the minimum wage to $15 an hour. Also we must raise the tax rate to 52%,’” according to the post, shared here and here.

“$15 an hour x .52% = $7.80,” it says. “$15 an hour - $7.80 = $7.20.”

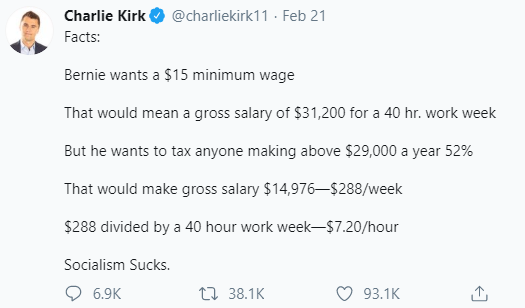

Another version of the claim has been made on Twitter here.

Sanders has repeatedly called for the minimum wage to be increased to $15 an hour from its current federal rate of $7.25.

He has also proposed a tax rate of 52 percent -- but not for people making $15 an hour.

A section of his website explaining how he would pay for his various plans lists “raising the top marginal income tax rate to 52% on income over $10 million” as an option.

Sanders also suggested the same marginal tax rate on income above $10 million during his 2016 run for president, according to an archived version of his website.

Even if the rate for Americans making $15 an hour was 52 percent, not all of their earnings would be taxed at that level, as the false claims state.

There is a standard deduction of $12,400 for individual filers in 2020, which means at least that amount of income would not be subject to taxes.

Sanders has emerged as the front-runner for the Democratic presidential nomination.

He is advocating using revenue from various tax increases on well-off Americans to pay for plans aimed at helping those with lower incomes.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us