No, bank customers in Nigeria do not receive fines paid by banks on failed electronic payments

- This article is more than six years old.

- Published on February 14, 2020 at 14:26

- 2 min read

- By Segun OLAKOYENIKAN, AFP Nigeria

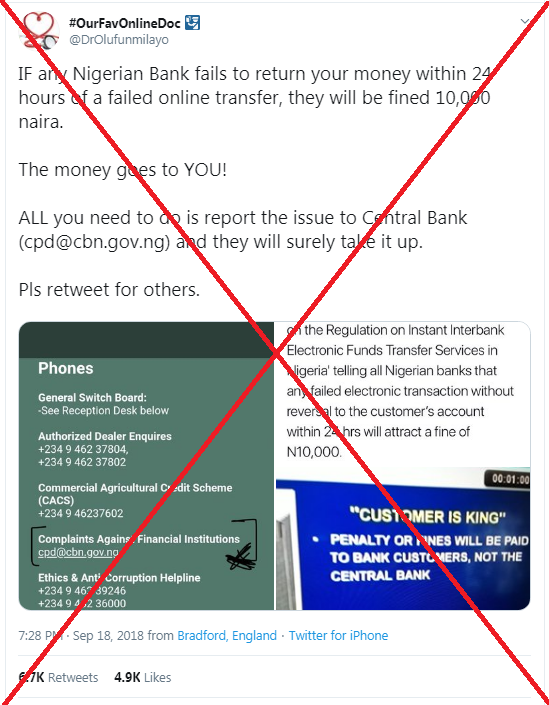

The claim was first shared on September 18, 2018, in a series of tweets on this Twitter account belonging to popular UK-based Nigerian medical doctor Harvey Olufunmilayo. The account has more than 100,000 followers.

The tweet has been shared nearly 7,000 times and reposted word for word in at least 100 Facebook and Instagram posts, as well as tweets. We've archived some of the posts here, here and here.

The caption on the tweet reads: “IF any Nigerian Bank fails to return your money within 24 hours of a failed online transfer, they will be fined 10,000 naira. The money goes to YOU! All you need to do is report the issue to Central Bank (cpd@cbn.gov.ng) and they will surely take it up.”

The claim was shared alongside three screenshots, among them contact details for the Central Bank of Nigeria (CBN) and an excerpt from the bank's announcement about the directive.

Nigerians largely rely on interbank instant payment channels for electronic transactions, but issues around failed and delayed payments remain a concern for the country which aims to financially include more of its inhabitants.

The claim is false, however, although the policy does exist.

What the regulation says

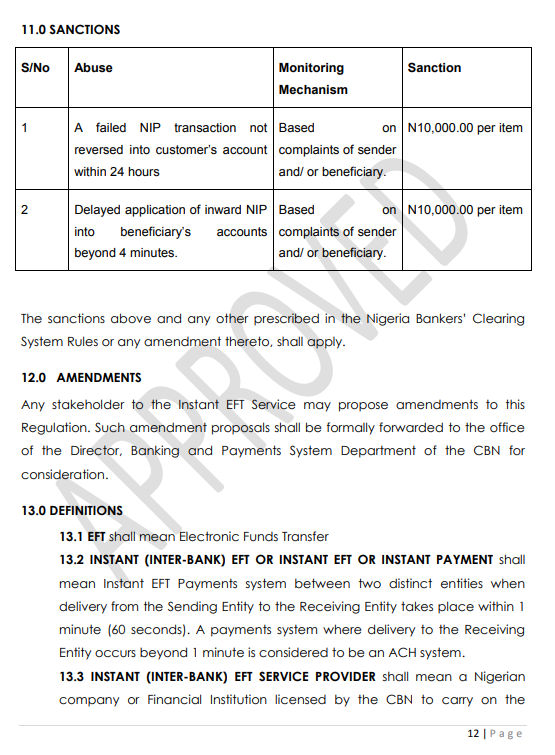

The central bank issued a circular to all financial institutions in September 2018, directing them to reverse failed payments -- official name being Nigeria Inter-Bank Settlement System (NIBSS) Instant Payment (NIP) -- into customers’ accounts within a day, or pay a 10,000 naira ($28) fine for each item “based on complaints of sender and/ or beneficiary.”

A similar sanction also exists for receiving banks that take more than four minutes to release funds into their customers' accounts.

These regulations on instant electronic funds transfer services in Nigeria are the central bank's attempt to "facilitate the development of an efficient and effective payments system" in the country and were effective on October 2, 2018.

Yet, more than a year later, misinformation around the regulation continues, like these Facebook posts published this year here and here, as well as this tweet with more than 9,000 likes.

Why the claim is false

There is no evidence to support the claim in the 14-page circular issued by the central bank on instant (inter-bank) electronic funds transfer services in the country, and neither was any official quoted saying affected customers stand in line to get the payment.

In fact, AFP found that the regulation is completely silent on where each 10,000 naira fine goes.

Central bank spokesman Isaac Okoroafor confirmed the claim was false. “The penalty for failed transactions does not go to the customer,” he said in an email to AFP.

Aderonke Akinsola, a banking analyst at Lagos-based investment bank Chapel Hill Denham, said there is no basis for the money to be paid to affected customers. “The payment goes to the regulator because it’s putting a policy (in place) for them (banks) to follow, and if they don't comply with the regulations, the fine would be a source of income to the regulator.”

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us