Canadian senior benefit is not reduced to pay older immigrants

- Published on August 25, 2025 at 23:20

- 2 min read

- By Gwen Roley, AFP Canada

"Canadians will be sacrificing part of their Old Age Pensions to allow elderly immigrants to receive a partial old age pension upon arrival!" says an August 16, 2025 X post.

The claim spread in English and French across X, Facebook and Instagram, with one user commenting that people "who are not Canadian citizens, have not worked at least a decade in Canada, ought not to receive any Old age benefit."

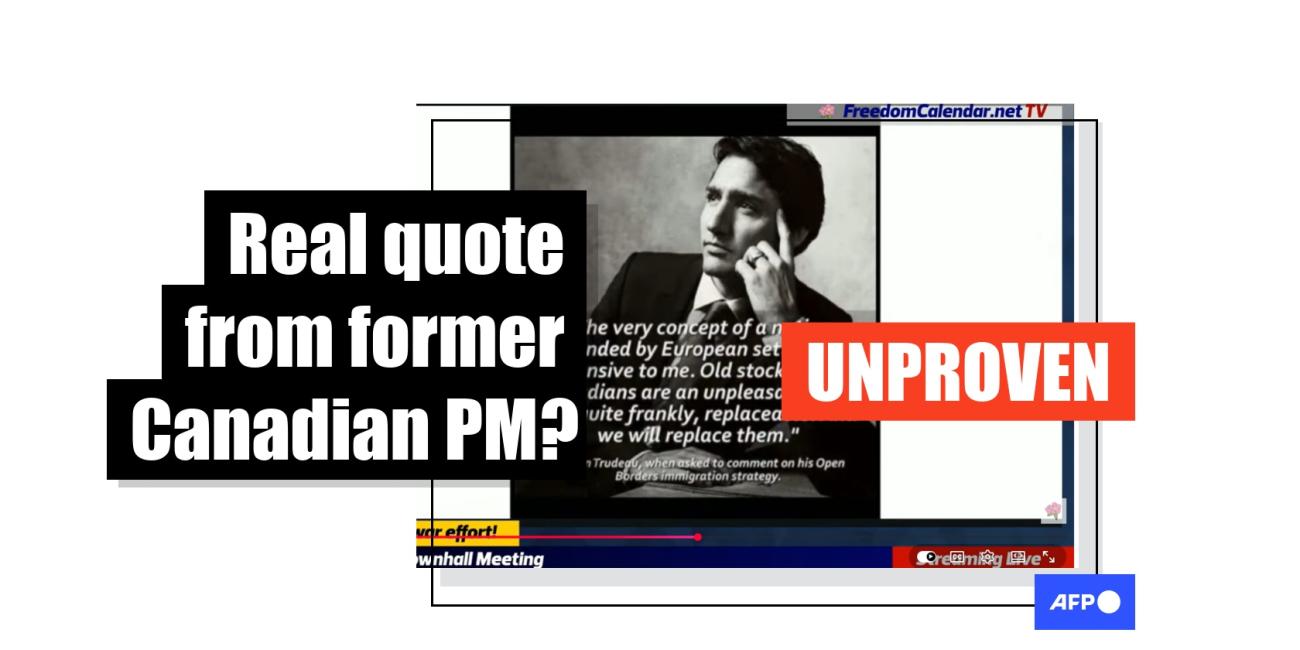

As Canada's previous pro-immigration consensus has broken down, AFP has fact-checked numerous misleading claims focusing on new arrivals. Many of the misrepresentations have centered on social assistance.

The claims about pensions follow reports in July 2025 that Canada plans to invite thousands to sponsor their parents and grandparents for permanent residency, a move that has sparked some debate online over how such older newcomers would be supported after entering the country (archived here).

There is no evidence, however, that funds earmarked for citizens' old age benefits would be redirected to support elderly immigrants.

Canada's Old Age Security (OAS) program provides a monthly payment to seniors over the age of 65 (archived here). Its objective is to ensure a minimum income for seniors funded by general tax revenues (archived here).

Any citizen or legal resident in Canada can apply for the benefit if they have lived in Canada for more than 10 years since the time they were 18 years old, according to the government's website. Unlike the Canada Pension Plan, to which workers contribute, OAS does not require a work history.

"The amount of a person's OAS pension is determined by how long he or she has lived in Canada," said Saskia Rodenburg, a spokeswoman for Employment and Social Development Canada, which manages the program.

Rodenburg added that pension rates "are not being reduced," citing legislation that guarantees the maximum benefit rate cannot go down (archived here).

Sponsorship and benefits

People in Canada can sponsor the immigration of parents and grandparents, but this requires committing to financially supporting these older family members (archived here).

The Immigration, Refugees and Citizenship Canada website states that participants should not ask for government social assistance and that any benefits they do receive must be repaid by the sponsor.

The sponsorship commitment period lasts 20 years in most provinces and 10 in Quebec, with the government refusing to shorten the period even if the family member becomes a Canadian citizen or the sponsor suffers an economic hardship such as job loss (archived here).

Similar to other legal residents, sponsored parents and grandparents are allowed to apply for OAS after residing in Canada for 10 years. New rules coming into effect in October 2025 will limit their access to additional income-based benefits for the entire length of the sponsorship agreement (archived here).

The Canadian Press reported that Canada has social security agreements with over 50 nations (archived here). These allow immigrants and Canadian expats to coordinate their pension programs if they spent time working both in Canada and abroad.

The amount dispensed still depends on how long they resided in Canada after turning 18 (archived here).

Seniors with high incomes -- more than $90,997 in 2024 -- are also subject to a recovery tax, requiring them to repay a portion of their OAS payments in accordance with the Income Tax Act (archived here and here).

Read more of AFP's reporting on misinformation in Canada here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us