Social media posts mislead on Malaysia's expanded sales and service tax

- Published on June 20, 2025 at 07:27

- 1 min read

- By Raevathi SUPRAMANIAM, AFP Malaysia

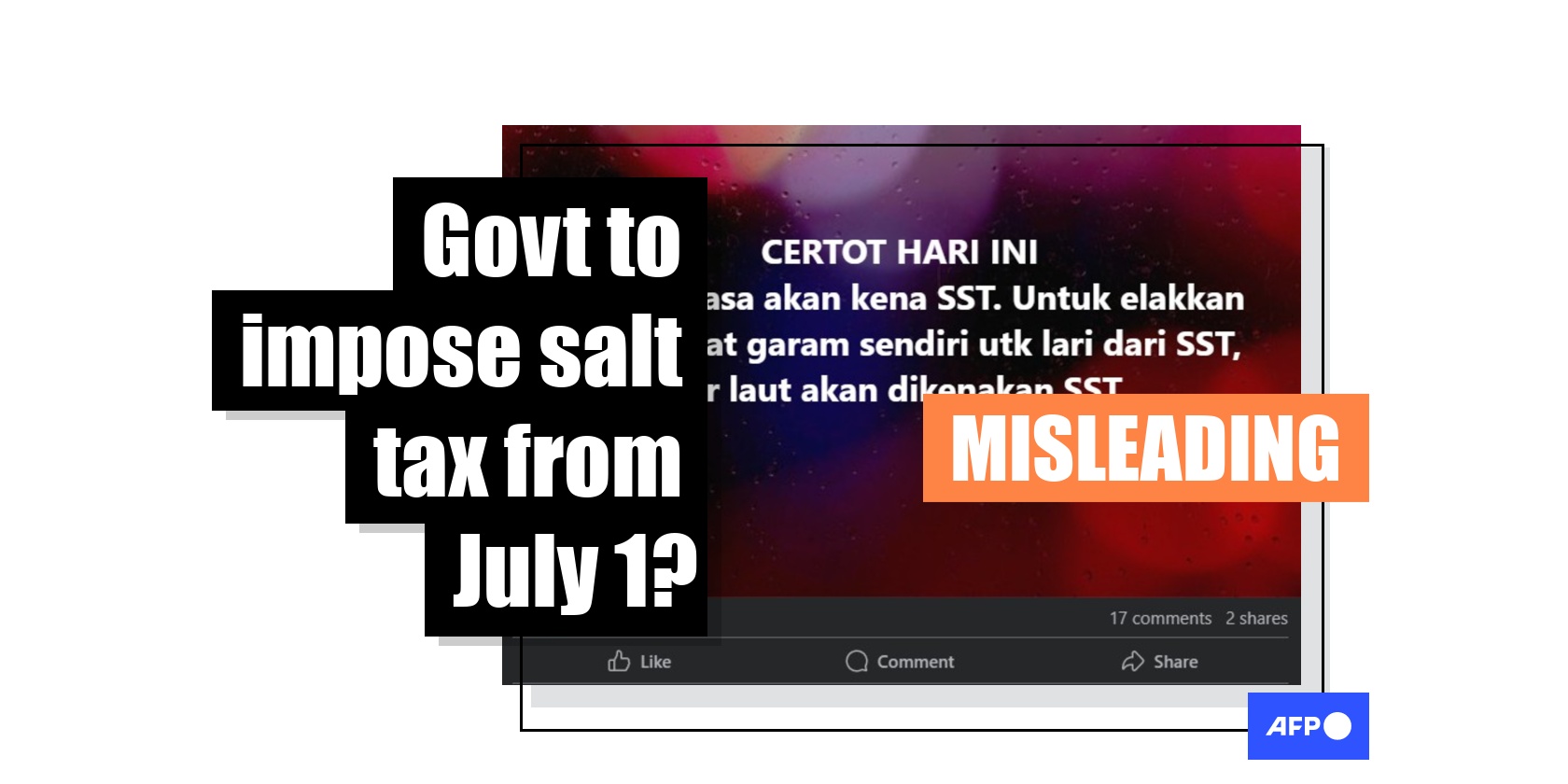

"Regular salt will be subjected to the SST. To prevent people from making their own salt, seawater is also being taxed," reads a Malay-language Facebook post published June 15, 2025.

The claim also spread elsewhere on Facebook.

It surfaced ahead of Malaysia's plan to increase revenue by expanding the scope of the SST on July 1 to previously exempt sectors, such as private health care, education and beauty services (archived here and here).

Many goods, including king crab, salmon and imported fruits, will be subject to a five or 10 percent levy after the expansion.

But salt -- along with other "daily essential goods" such as sugar, white bread and noodles -- are exempt, according to a list published by the finance ministry on June 9 (archived here and here).

Beninder Singh, deputy president of the Malaysia Consumers Movement, also refuted the online posts.

"For any information, we should only rely on the government's official announcement," he said, advising the public to refrain from spreading false information.

Johan Mahmood Merican, secretary general of the treasury in the Ministry of Finance, also told Malaysian outlet The Business Station on June 18 that only premium salts are subject to the revised SST, while common household salts are exempt (archived here).

He went on to explain that "seawater" as listed in the revised SST actually refers to saline solution used in the pharmaceutical sector.

"So if you decide to go down to the beach and scoop some water, that certainly is not subject to sales tax."

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us