Malaysian national pension fund warns public against unauthorised loan offers online

- This article is more than one year old.

- Published on October 11, 2024 at 04:48

- 2 min read

- By Najmi MAMAT, AFP Malaysia

"Want a loan but don't want monthly payments? Our company has prepared an EPF loan scheme for those who are eligible to withdraw from the retirement fund within the upcoming 24 months," read a Malay-language Facebook post on September 11, 2024. "Borrow first, pay later using EPF withdrawals."

The post went on to state it was open to those aged 53 or 54, while the EPF allows withdrawals from age 55.

The post and accompanying graphic claimed that the process of applying for the loan was easy and would "only take one hour".

The post also featured the official logo of the EPF, and listed a private mobile phone number as a contact for those looking to apply.

Hoax posts misusing government logos and impersonating different ministries claiming to offer cash aid or other services have regularly surfaced in Malaysia, debunked by AFP here and here.

Other posts advertising a purported "EPF loan" also surfaced on Facebook here, here, and here. One version of the infographic advertising a loan from the pension fund has circulated online since at least 2021.

Unauthorised third party

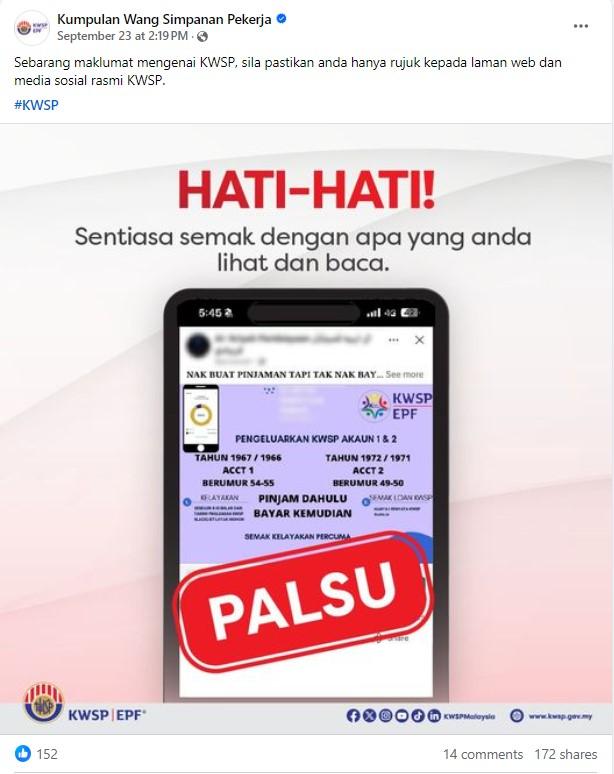

Keyword searches on Google led to a Facebook post published on the verified page of the EPF on September 23, 2024 that labelled the infographics circulating online as "fake" (archived link).

"For any information about the EPF, please make sure you only refer to the EPF's official website and social media," read the Malay-language post.

An EPF spokesperson told AFP on October 8 that the accounts advertising the purported loans are not affiliated with the retirement fund and they do not endorse any such offers and schemes through third-party transactions.

"Our main role is to manage and grow the retirement savings of the members, and we do not engage in or support any money lending activities," the spokesperson said.

In April 2023, the Ministry of Finance announced a plan that would allow EPF members to set up a separate account to pay off personal loans that they took out from banking institutions, but the scheme did not mention any loans provided by the pension fund (archived link).

Applications for this financing scheme closed in April 2024.

Ordinarily, those approaching retirement age can make withdrawals from the EPF under a few conditions, according to the official website.

Those aged 50 are able to make a one-time partial withdrawal from the fund, while at age 55 -- the official retirement age -- all or part of the savings can be withdrawn. If a person chooses to keep working past 55, contributions to the fund will continue and can be withdrawn at 60 (archived links here and here).

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us