Saudi Arabia did not scrap '50-year petrodollar deal' with United States

- This article is more than one year old.

- Published on August 6, 2024 at 04:08

- 3 min read

- By Théo MARIE-COURTOIS, AFP France, AFP Hong Kong

- Translation and adaptation Tommy WANG

"The anchor of the US dollar has loosened? Saudi-US 50-year petrodollar deal ends, Saudi Arabia won't renew it," read a simplified Chinese X post shared on June 14, 2024.

According to text overlaid on the video, the "50-year petroleum deal" was signed on June 8, 1974 after the oil crisis of the previous year.

The false post surfaced after Saudi Arabia -- whose national currency, the riyal, is pegged to the dollar -- reportedly joined China in a multi-country digital currency project (archived link).

Bloomberg previously reported that the two countries had signed a currency swap agreement, in the latest sign of deepening ties between the Arab state and its biggest trade partner (archived link).

Similar posts that falsely claimed a "50-year petrodollar deal" had ended also spread on X, WeChat, Facebook and TikTok, as well as in other languages including English and French.

US-Saudi agreement

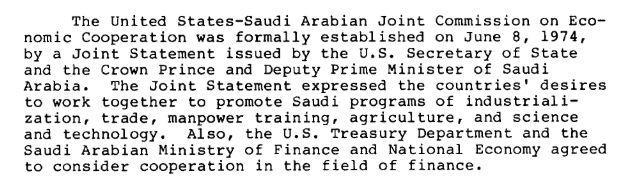

According to a report on the website of the US Government Accountability Office (GAO), the auditing arm of the US Congress, the deal struck between the United States and Saudi Arabia on June 8, 1974 aimed to foster closer political ties through economic cooperation (archived link).

"The Agreement would remain in effect for 5 years from the date of signature, subject to revision or extension as mutually agreed, and could be terminated at any time by either government with 180 days advance notice in writing", the report said.

Neither AFP nor experts found any trace in the agreement of an expiry date set at 50 years.

Below is a screenshot of the agreement stating when it was formally announced.

The deal came months after the first oil shock caused by the Yom Kippur war, when Egypt and Syria launched a surprise attack on Israel to try to win back their lost territories (archived link).

Six Arab members of the OPEC oil cartel declared an embargo on exports to countries supporting Israel, notably the United States. They quadrupled oil prices, provoking recessions in Western countries and steep inflation.

Following the oil shock, "the big question was where these petrodollars that were flooding the world were going to be invested," said Francis Perrin, a senior research fellow at the French Institute for International and Strategic Affairs and a specialist in energy issues (archived link).

"The Americans wanted a large portion of them to be invested in the American economy or to buy American Treasury bonds."

But the deal "does not say that Saudi Arabia must do absolutely everything in dollars, in terms of oil".

Oil prices on the international benchmark Brent and its US counterpart WTI are set in dollars "because the dollar is the world's reserve currency," Tamas Varga, an analyst at PVM Oil Associates, explained to AFP.

"Since the United States is the world's largest economy, its currency can be freely traded. It is the dominant currency that has governed international trade since the Bretton Woods agreements after the Second World War."

While it was "absolutely true that Saudi Arabia is keen to diversify the currencies in which oil transactions are made", Perrin said there was "no fundamental questioning by the country of the dollar's role in the oil sector".

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us