False retirement ads targeting Canadians spread on Facebook

- This article is more than one year old.

- Published on May 29, 2024 at 22:48

- 3 min read

- By Gwen Roley, AFP Canada

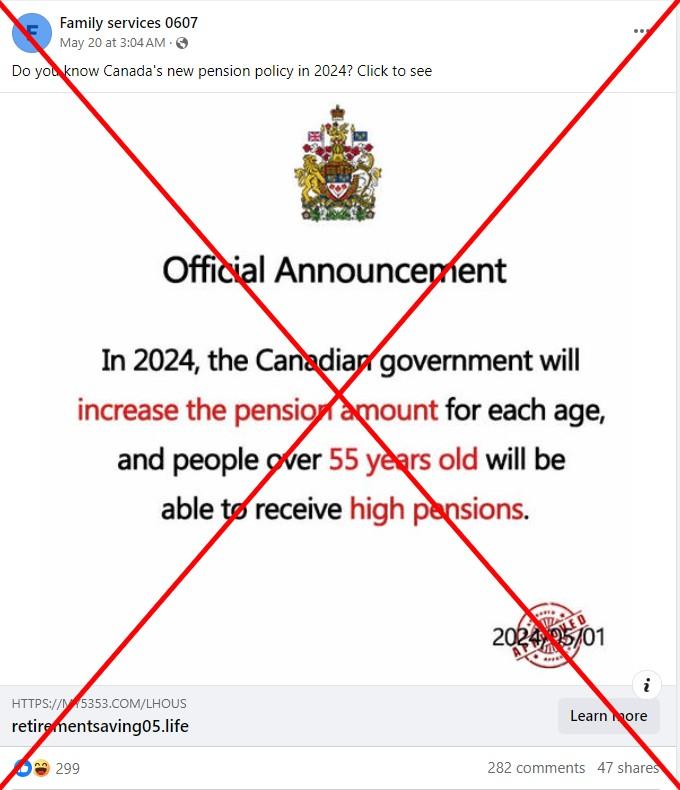

"Do you know Canada's new pension policy in 2024? Click to see," says a May 20, 2024 Facebook ad.

Accompanying the text is an image that claims an "official announcement" from the Canadian government said pension amounts are increasing and are available to people older than 55.

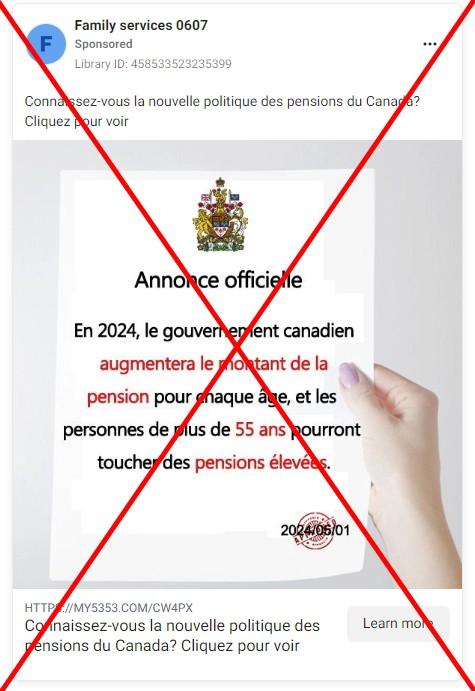

Similar posts in English and French have racked up hundreds of interactions despite many commenters expressing skepticism about the offer.

The federal government says on its website that anyone who contributed to the public Canada Pension Plan (CPP) while working between the ages of 18 and 70 is eligible for the monthly retirement benefit. The amount is determined by age and how much one paid into the plan (archived here and here).

The CPP covers nearly all employed and self-employed people in Canada (archived here) -- excluding the province of Quebec, which has its own program called the Quebec Pension Plan (QPP, archived here).

However, according to the CPP site, the earliest age to start receiving the pension is 60 years old -- and Environment and Social Development Canada (ESDC) told AFP this was not recently changed. The QPP website says 65 is the "normal retirement age" (archived here).

"Websites and posts claiming that pension amounts will increase by age for those older than 55 are simply not true," ESDC spokeswoman Liana Brault said in a May 28 email.

Cost-of-living adjustment

The CPP benefit does increase annually (archived here) in accordance with inflation measured by the Consumer Price Index (CPI) All-Items Index (archived here). Brault said the benefit rose by 4.4 percent in January 2024.

"Tying CPP benefits to the CPI yearly ensures payment amounts respond to changes in the cost of living," Brault said. "If inflation goes down, benefit payments stay the same. They will never decrease."

A different Canadian social benefit, the Old Age Security program, is available to those over the age of 65 and is also determined by changes in the CPI. Brault said these amounts are updated four times a year (archived here and here).

Unreliable page

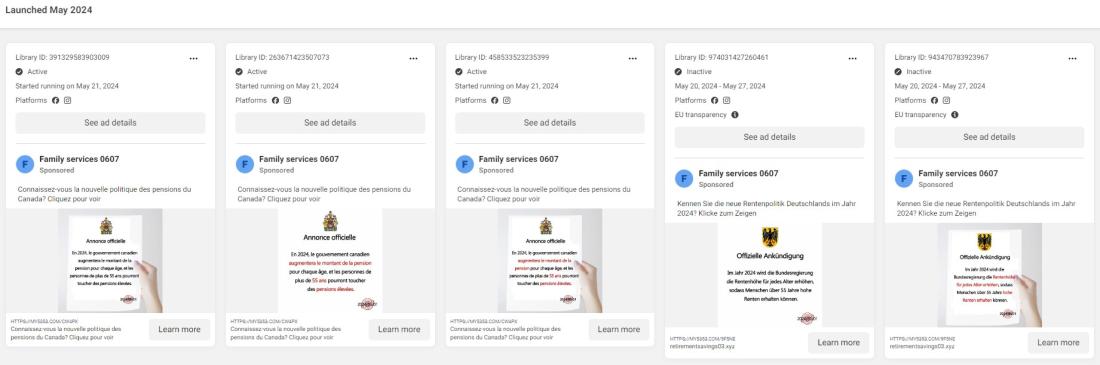

According to the Meta Ad Library, the Facebook page spreading many of the posts shared nearly identical ads in French, while paying to boost ads targeting Germans earlier in May.

The ads share a landing page linking to information about retirement plans and pension benefits.

The linked sites are not government sources and include advice on investing, wealth management and retirement. The content appears to target people living in the United States, with references to "states served" and Individual Retirement Accounts, which are considered foreign arrangements in Canada (archived here).

AFP has previously fact-checked ads falsely offering financial payouts to Canadians. The country has reportedly seen an increase in telephone investment scams, and despite reports that these campaigns frequently target seniors, a recent survey found younger people are increasingly falling victim to fraud (archived here).

Read more of AFP's reporting on misinformation in Canada here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us