Misleading claims circulate on influence of BlackRock, Vanguard

"BlackRock and Vanguard: The Two Giants that Own Everything," says a March 25, 2024 Facebook post. "Their ownership stakes in top corporations make them significant players in determining market trends and the future of many industries."

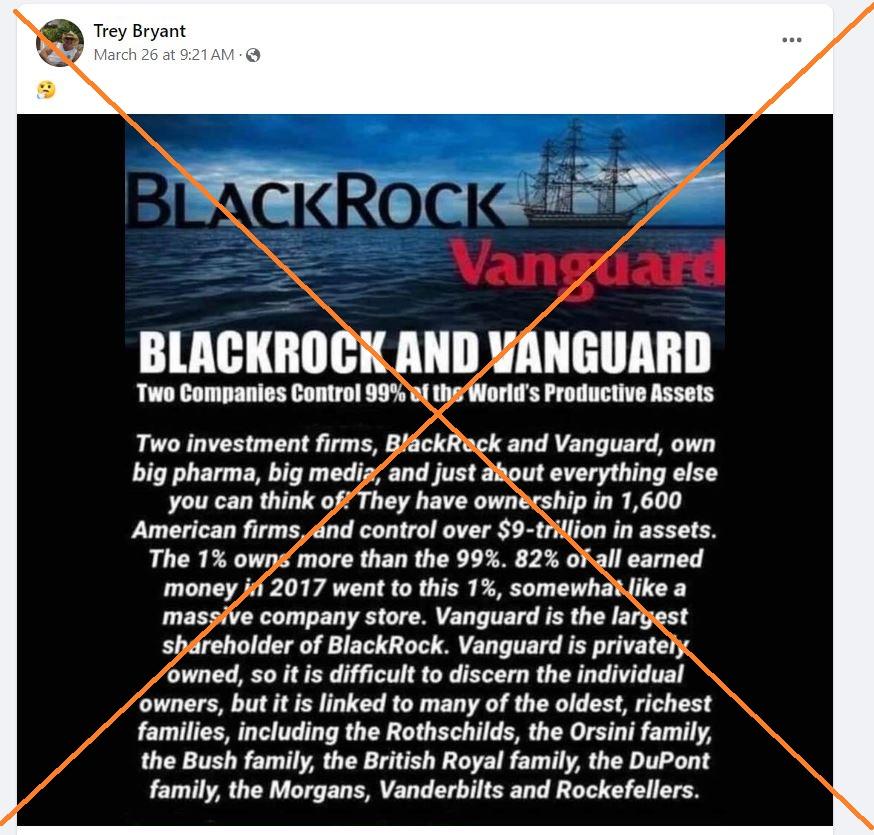

Another Facebook post claims: "Two Companies Control 99% Of the World's Productive Assets," adding that the firms "own big pharma, big media and just about everything else you can think of!"

Similar iterations of the claim have circulated on Instagram, TikTok, Rumble and X for years.

BlackRock and Vanguard are large and wield huge stock buying power, but claims of their market control are misleading.

The massive figures cited online represent "assets under management" (AUM), or money invested on behalf of clients. BlackRock's AUM figure hit $10 trillion at the end of 2023, while Vanguard's was around $8.6 trillion (archived here and here).

That is significant, although not a majority of a total US stock market value estimated at $50 trillion or a global market of more than $100 trillion.

And while the asset management firms are listed as the shareholders of record for publicly traded firms such as Apple and Amazon, the money belongs to underlying investors.

"The money we manage is not our own. It belongs to the individuals and organizations representing more than 120 million people," BlackRock says on its website (archived here).

The US firm's clients include foundations, pension funds and other institutional and individual investors. Vanguard, meanwhile, is owned by its 50 million individual investors.

"We are an asset manager, not an asset owner," the company says on its website (archived here). "The assets we manage belong to the tens of millions of individual investors who have entrusted us to grow their savings over time."

'Inherently passive'

US Securities and Exchange Commission rules (archived here) require institutional or individual investors acquiring more than five percent of a company to disclose whether they will be a "passive" shareholder or one seeking to control or influence the firm.

BlackRock and Vanguard filings (archived here and here) say their investments are "not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities."

Vanguard says in its stewardship document (archived here) that its investment approach "is inherently passive."

"Accordingly, with respect to companies held by Vanguard-advised funds, we do not seek to dictate strategy or operations, nor do we submit shareholder proposals or nominate board members," the firm says.

A large percentage of the investments are in funds designed to mirror the composition of a stock index such as the S&P 500.

Those funds are required to hold shares in proportion to the index, which limits the influence of investment firms.

"They're not going to say, 'We don't like what you're doing so we're going to sell the shares.' And that limits the amount of control associated with those votes," said Margaret Blair, a professor emerita at Vanderbilt University focusing on corporate law and finance (archived here).

Acting in concert?

Former Republican presidential candidate Vivek Ramaswamy and some lawmakers have suggested BlackRock and Vanguard, as well as the large investment group State Street Corporation, act together to promote "ESG" objectives, a term referencing environmental, social and governance goals.

The firms say they make independent assessments when controversial issues come up before a corporate board.

"Our investment decisions are governed strictly by our fiduciary duty to clients," BlackRock says on its website (archived here). "We have not made commitments or pledges to meet environmental standards that constrain our ability to invest our clients' money on their behalf consistent with their objectives."

Vanguard's investment stewardship document says: "Vanguard does not use investment stewardship actions to pursue any public policy objectives. We believe that public policy, including public policy on social and environmental matters, is appropriately the responsibility of elected officials" (archived here).

A 2023 analysis by the investment research firm Morningstar (archived here) found the three firms do not vote as a bloc -- in fact, they often disagree on shareholder resolutions about ESG issues.

As part of their transparency efforts, both BlackRock and Vanguard publish detailed reports on investment stewardship principles (archived here and here), as well as periodic reports highlighting their votes.

Pass-through voting

Amid concerns about the size of their holdings, both BlackRock and Vanguard have in recent years launched pass-through voting pilot programs that allow some underlying shareowners to vote on issues before corporate boards.

"BlackRock believes that greater choice should extend to shareholder proxy voting and is committed to a future where every investor can participate in the proxy voting process," its website says (archived here).

"BlackRock Voting Choice (sometimes known as pass-through voting) provides eligible clients with more opportunities to participate in the proxy voting process where legally and operationally viable."

Vanguard said in a December 2023 announcement expanding this effort: "We are committed to exploring all available options so our investors' portfolios can reflect their investment goals and preferences" (archived here).

Blair said that as a practical matter, only a few consequential issues related to corporate management come up for a shareholder vote.

"For the most part, directors are free and expected to and are required by the law to manage the corporation," she said March 31, 2024.

But large asset managers may help bring issues to the attention of boards.

"They're not voting on whether the company should invest in synthetic fuels or shut down its pipeline or whether it should start moving out of carbon-based products altogether," Blair said.

For large asset managers, "their fiduciary duties are to their investors," she said.

AFP has previously fact-checked claims about BlackRock here and wealth concentration here.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us