Post falsely claims Tanzania dumping US dollar for gold as reserve currency

- This article is more than two years old.

- Published on October 18, 2023 at 09:38

- 3 min read

- By Erin FLANAGAN

“Tanzania dumps the dollar for gold in their foreign reserves. What’s your opinion on this?” reads the caption of a post on X, formerly Twitter, published on September 27, 2023.

Liked more than 2,000 times, the post includes an announcement from the Bank of Tanzania (BoT) about plans to purchase gold from domestic miners and traders.

The BoT is responsible for setting monetary policy, issuing the Tanzanian shilling, and supervising other banks and financial institutions.

“The Bank of Tanzania wishes to inform the public on the commencement of the Domestic Gold and Purchasing program, which aims to bolster foreign exchange reserves through acquiring and holding gold. The Bank is therefore purchasing gold from domestic miners and traders in Tanzanian Shillings (sic),” reads the official notice signed by the bank’s governor, Emmanuel Tutuba.

The bank posted the announcement to X in both Swahili and English on September 25, 2023 (archived here).

— Bank of Tanzania (@BankOfTanzania) September 25, 2023

Tanzania, like many East African countries, has been managing a dollar scarcity alongside a surging cost-of-living crisis (archived here).

In August 2023, the Tanzanian shilling hit an all-time low against the dollar, which means people are paying more for imported goods (archived here).

The government has taken steps to mitigate the issue, including buying gold to boost the country’s foreign exchange reserves (archived here).

However, the claim that Tanzania is “ditching” the dollar as a reserve currency is false.

Gold-buying programme

Using a keyword search for “Tanzania gold buying programme,” AFP Fact Check found remarks by Tutuba in a local news report detailing the plan (archived here).

During a visit to a gold refinery, Tutuba explained that the BoT was buying gold to diversify its foreign exchange reserves and lessen reliance on one currency.

“Now, for the first time, we have both a gold and dollar reserve. Previously, we only had the US dollar as a foreign exchange reserve,” Tutuba said.

AFP Fact Check reached out to the central bank to confirm his comments.

“The bank has the responsibility of managing the nation's foreign reserves, which encompasses gold among other assets such as dollar reserves,” said the bank’s spokeswoman Anna Lyimo.

“The intent behind this programme is to bolster our reserves … and to diversify our foreign reserve investments for optimal benefit. It is imperative to note that the bank does not plan to replace the dollar or any other reserve currency exclusively with gold. In a nutshell, gold is merely one component of our diverse foreign reserve portfolios,” she added.

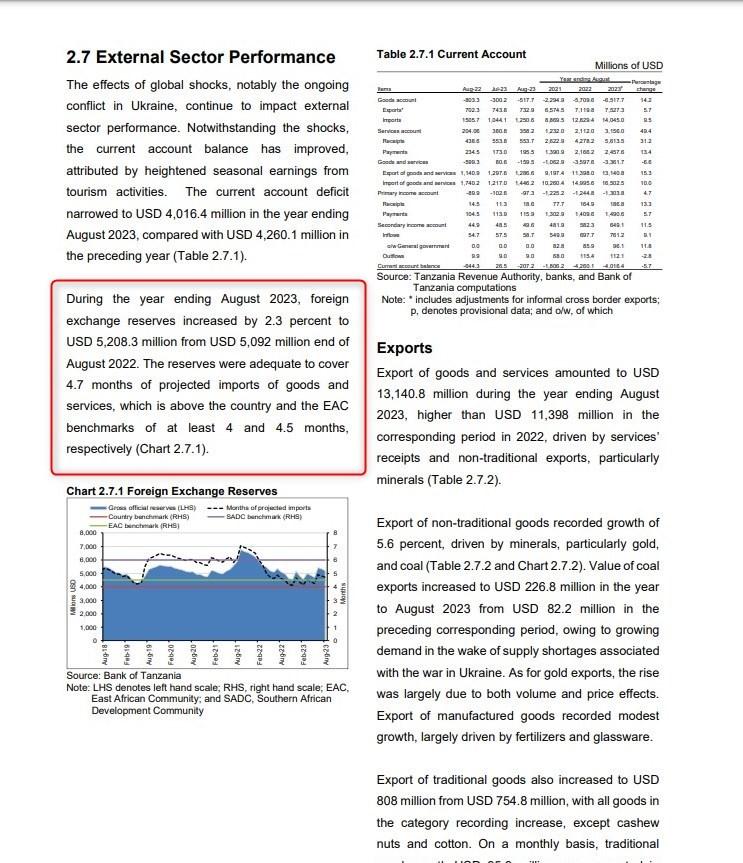

In their September 2023 economic report, the BoT announced that foreign exchange reserves had increased by 2.3 percent to $5.208 trillion – enough to cover nearly five months of projected imports of goods and services.

The East African Community, a regional bloc encompassing seven countries, including Tanzania, recommends reserve holdings covering at least 4.5 months of projected imports (archived here).

AFP Fact Check has debunked other false claims about the US dollar in Nigeria and Kenya.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us