Posts claiming US economy in 'silent depression' use skewed data

"We are currently making less than the height of the Great Depression," says an August 23, 2023 TikTok video from Isabel Brown, a conservative activist at Turning Point USA, with more than 3.6 million views.

Another TikTok post from September 3 claims similarly: "We are currently experiencing what I like to refer to as a silent depression -- a period that is arguably worse than the Great Depression of the 1930s."

Both videos refer to an Internal Revenue Service (IRS) report showing the average annual income of tax filers in 1930 was $4,887, the equivalent of more than $80,000 today after adjusting for inflation.

Similar claims circulated in articles and on platforms such as Facebook, YouTube, Reddit, Rumble and X, formerly known as Twitter.

However, the IRS report (archived here) only reflects data from 3.7 million tax filers in 1930 -- a small fraction of that year's population of 123 million.

That is because only the top income tiers were required to file returns at the time. In contrast, some 150 million tax returns were filed in 2022 out of a population of 330 million (archived here).

As a result, the old figures are not a representative average and do not reflect the incomes of average Americans during the Great Depression.

"The average salary in 1930 was not $4,887. In 1930, the threshold to file taxes was $3,000," said Abdullah Al-Bahrani, an economist at Northern Kentucky University (NKU), in a September 8 blog post (archived here).

"Only six percent of the US population filed taxes. Most had incomes below that threshold. Therefore, by looking at the average income for individuals filing taxes, the analysis relies on a sample of high-income earners."

Al-Bahrani instead cited US Census data (archived here) showing a mean annual income of $1,368 in 1930, equivalent to about $24,927 today.

That is less than half the current median salary of $57,200 -- and far below average wages of $61,900 in 2022 (archived here and here).

"Clearly, our financial well-being (based on income) is drastically improved compared to the Great Depression," Al-Bahrani said on his blog.

Different economic conditions

Other "silent depression" claims circulating on Instagram, X and TikTok cite an accurate figure for annual incomes in 1930 while arguing housing, cars and other goods are less affordable today.

These posts, which compare costs as a multiple of income, lack context.

Economic conditions were markedly different in the 1930s, with unemployment hitting a peak of 25 percent compared with 3.8 percent in August 2023 (archived here and here). There was also a surge in bankruptcies and bank failures (archived here).

"The Great Depression was a cataclysmic event," says a 2008 report from the Federal Reserve Bank of St. Louis (archived here).

"Between 1929 and 1933, US personal income declined 44 percent, real output fell by 30 percent and the unemployment rate climbed to 25 percent of the labor force."

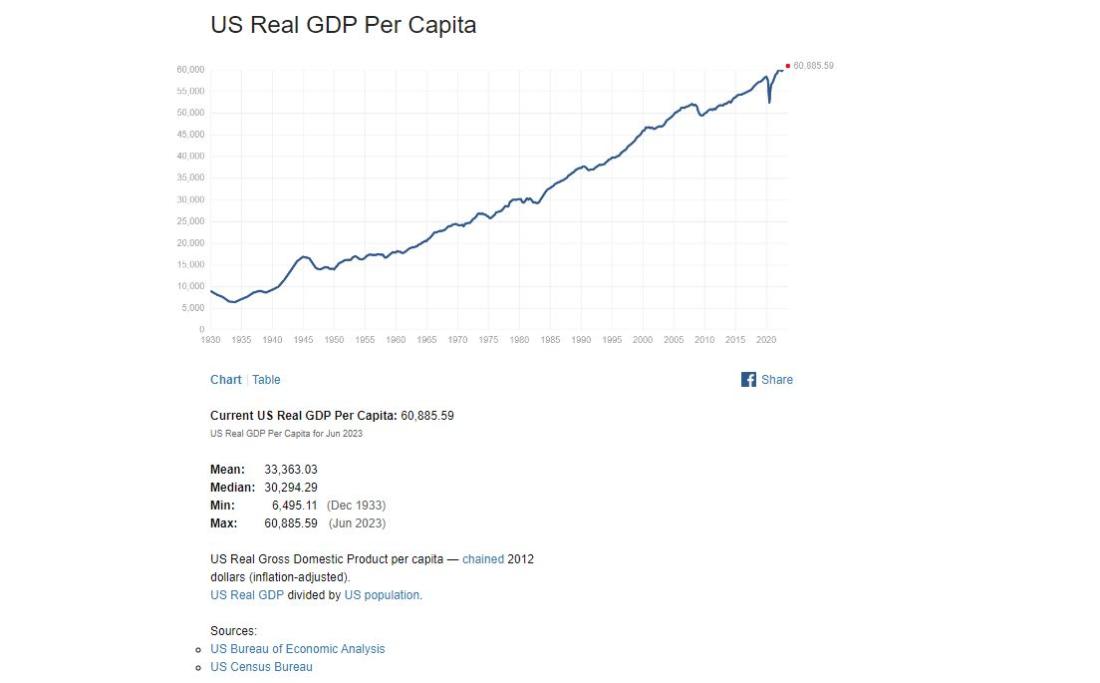

Lee Ohanian, a University of California-Los Angeles (UCLA) economist and Hoover Institution senior fellow who has written about the Great Depression, said that to compare these periods, "the most comprehensive measure of economic well-being is per-capita real (gross domestic product)."

By this measure (archived here), "there is a more than seven-factor increase since 1930," Ohanian said in a September 11 email.

"Unemployment is a useful measure as well, as it shows the percentage of people who are looking for work but remain unemployed. It was much higher in the Great Depression than today," Ohanian added. "There are also many more safety net programs today than in the early 1930s."

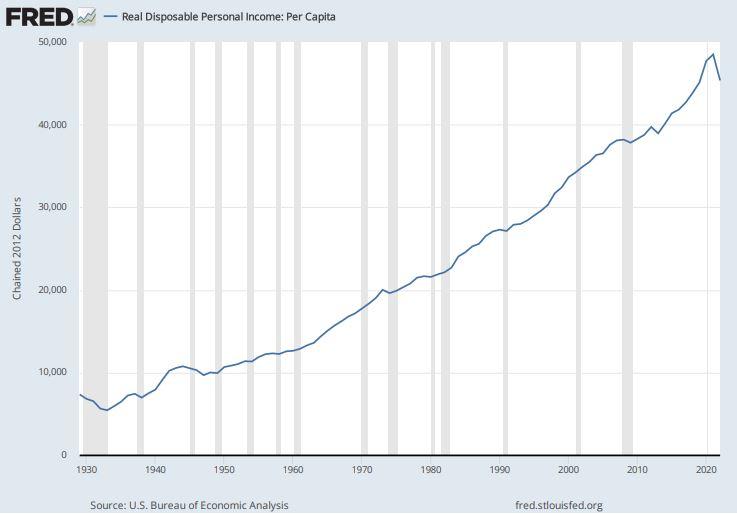

Another metric is real disposable personal income. Data from the US Bureau of Economic Analysis (archived here) shows that was $6,836 annually in 1930 and $45,343 in 2022 -- roughly 6.5 times higher.

Affordability

The affordability issues raised in the posts fail to consider the broader context of the Great Depression, a period when millions of people lost their homes and lived in shack towns and camps. Housing prices fell by 67 percent during the period in response to economic conditions, according to Harvard University researchers (archived here).

Economists say comparing prices to incomes fails to tell the whole story due to the deflationary environment of the 1930s, which paralyzed economic activity (archived here).

"Deflation was an important cause of falling incomes and financial distress, as households and firms found it increasingly difficult to repay debts," the 2008 Federal Reserve report says. "Because debt contracts almost always specify repayment of a fixed-dollar sum, deflation increases the real cost of a given nominal debt."

Deflation led to numerous foreclosures, with as many as half of all loans delinquent in 1934, according to the Federal Reserve (archived here). Bank failures compounded the problem.

Organized consumer credit was also not widely available in the 1930s, NKU's Al-Bahrani said, and there were not any federal loan guarantee programs.

Without credit, "you'd have to save all of your income for five years before you're able to purchase a house" in the 1930s, he added.

In many cases, home loans were short-term and had to be refinanced after a few years, according to the Fed report -- but bank failures "made refinancing difficult even for good borrowers."

Nonetheless, economists say there are elements of stress in today's economy, including income inequality and housing affordability.

"When you start in your career you're going to be below average as far as income. What's different today is people are not seeing the path to increases in income," Al-Bahrani said.

"There's a bit of frustration there -- that I understand. But comparing it to the 1930s I think is not helping the cause."

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us