Online scam targets Facebook users with false information about Ethiopian bank

- This article is more than two years old.

- Published on July 28, 2023 at 10:44

- 2 min read

- By AFP Ethiopia

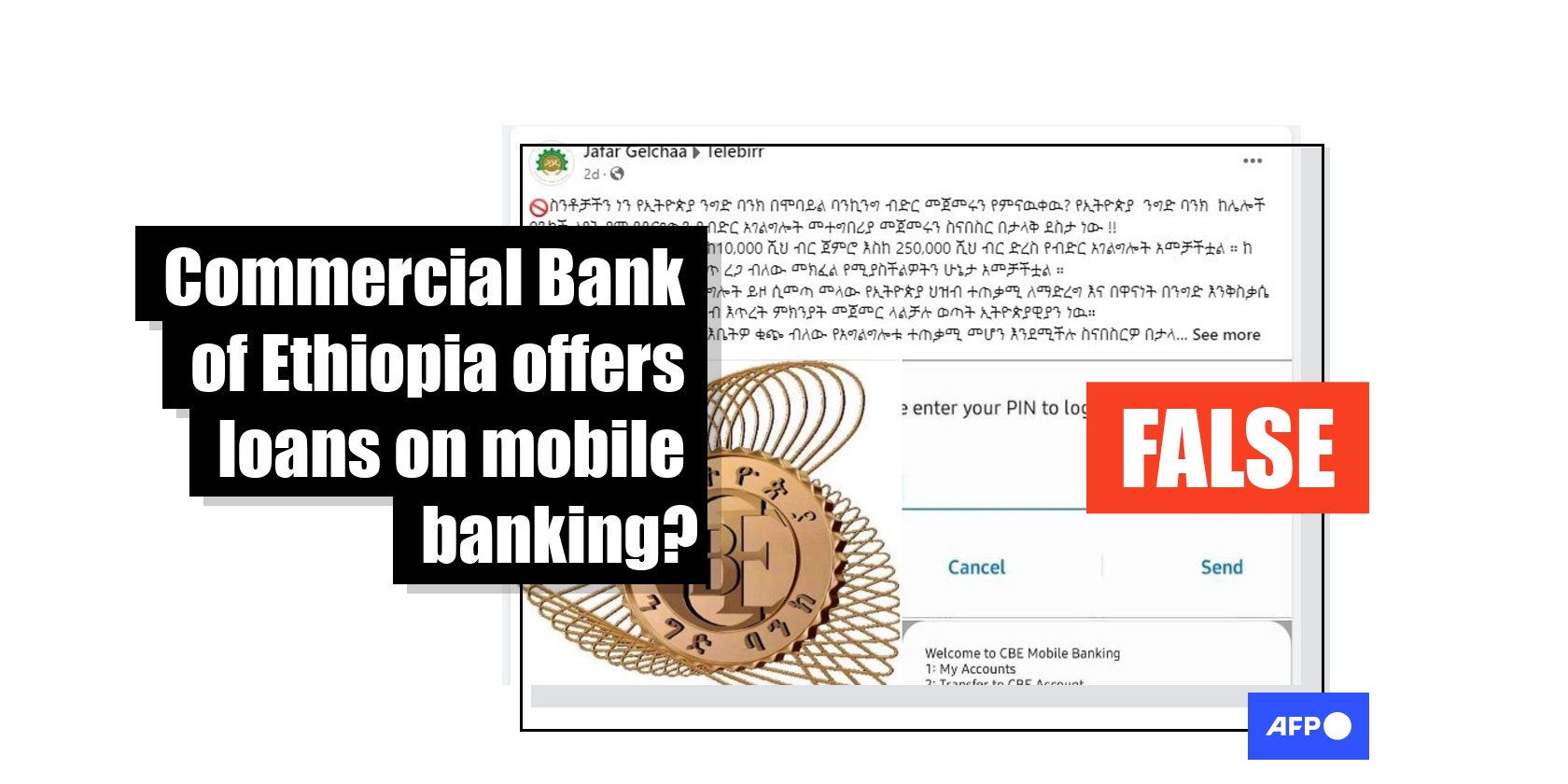

Written in Amharic, the post reads: "How many of us know that Ethiopian Commercial Bank has begun loans via mobile banking? We hereby announce with great pleasure the launch of the Commercial Bank of Ethiopia loan service application that makes it different from other banks."

Several images in the post appear to show a step-by-step application process.

"The bank facilitates loans through mobile banking services from 10,000 birr to 250,000 birr (from $180 to $450). You have the chance to pay the loan back free of interest over a period of two years," the text says.

To obtain a loan, users are first asked to deposit a minimum of 10,000 birr ($180) into their CBE account. The bigger the deposit, the larger the loan they can access. Potential clients are then persuaded to enter their passwords with a string of other numbers and "codes" to secure their loans.

The post was published on a public Facebook group called “Telebirr” with 54,000 followers. The person who published the claim switched off the comment option, meaning anyone with suspicions about the post cannot warn others.

The state-owned CBE is Ethiopia's largest bank and mobile banking is part of the services it offers.

However, clients cannot apply for loans on mobile banking.

Scam post

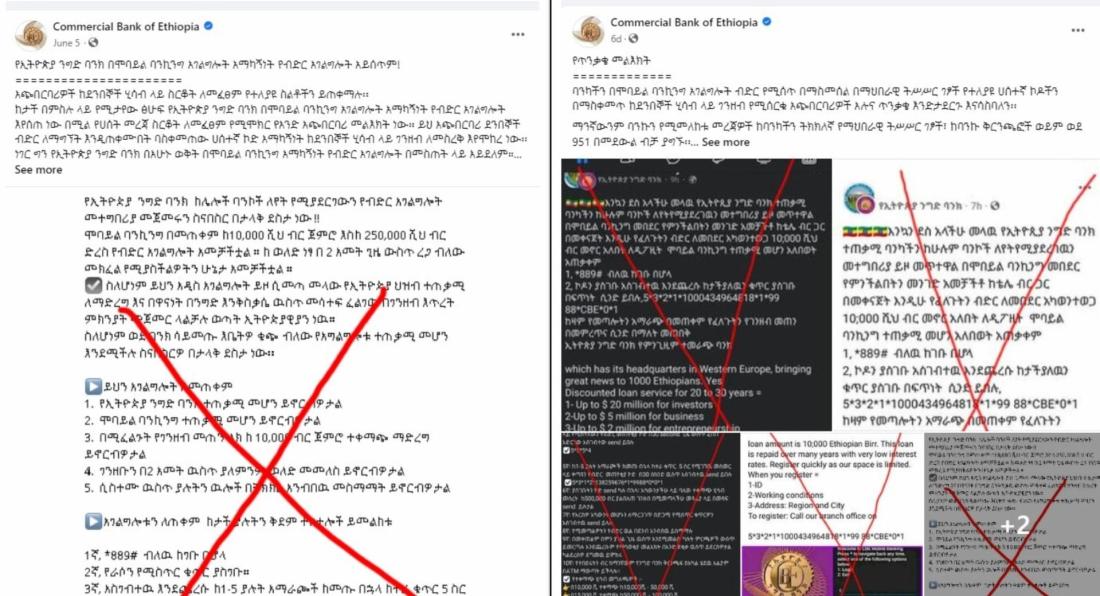

The CBE has repeatedly warned customers on social media about fraudsters targeting the bank’s mobile banking division.

"We urge you to be careful of fraudsters who steal money from customers' accounts by using different fake codes on social media pages pretending that our bank provides loans through mobile banking services," the CBE said in a message posted on Facebook on July 19, 2023 (archived here).

Screenshots of similar online scams were included in the post.

In an earlier warning (archived here), the bank reiterated that it does not provide credit through mobile banking.

Local media reported last year that mobile banking fraud in Ethiopia primarily targeted the CBE and was on the rise (archived here).

A study released by the Ethiopian Ministry of Justice in June 2022 also revealed that the banking industry in the country had lost close to two billion birr (about $36 million) due to fraud in the last four years, half of it incurred by CBE (archived here).

The CBE is yet to reply to AFP Fact Check's request for comment.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us