Posts misinterpret proposed reforms to Philippine military pension

- This article is more than two years old.

- Published on July 31, 2023 at 10:40

- 3 min read

- By Lucille SODIPE, AFP Philippines

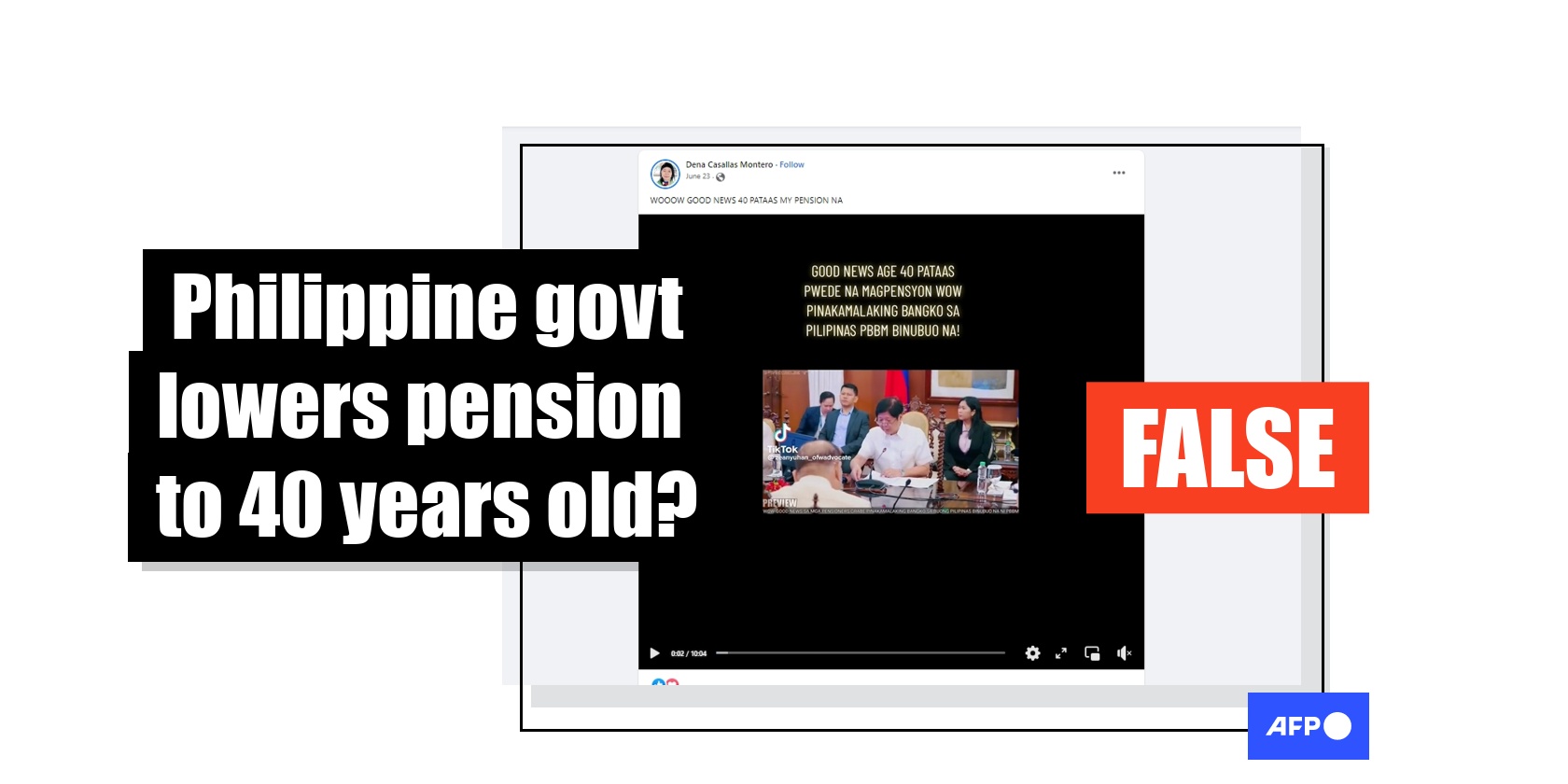

"Good news! Those aged 40 years old and above can now receive their pension. Wow," reads Tagalog-language text overlaid on a 10-minute video shared on Facebook here on June 23.

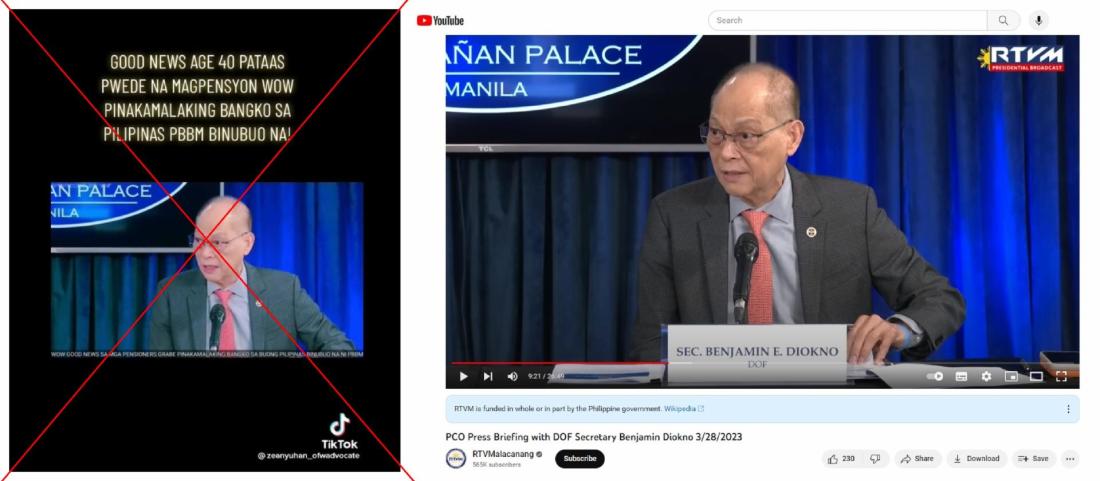

The first minute of the video has the word "Preview" in its bottom-left corner and shows Philippine Finance Secretary Benjamin Diokno speaking to journalists at a press briefing.

He begins by saying: "Now the current pension system is like this, it's fully-funded by the national government."

Diokno also says: "Pension can be received after 20 years of service with no minimum pensionable age, so some of them get recruited at the age of 20 so they can already retire at the age 40."

Similar footage was shared on Facebook, TikTok and on YouTube, where it has attracted more than 490,000 views in total.

Some social media users appeared to believe the video showed Diokno announcing a new state pension policy.

"Wow, this is a big help to single parents like me," one commented.

Another asked: "How can I avail of this? I am already 46."

Military pension reform

But a review of the full 10-minute video shows Diokno was explaining why the pension system for the police, military and other uniformed personnel needed to be reformed.

He was speaking at a press briefing of the Presidential Communications Office on March 28 about two proposals from the finance department (archived link).

There was no announcement about any changes to the Philippines' old-age pension programme.

According to a transcript of the 26-minute briefing, Diokno was referring to the military's "unique kind of pension system".

"Pension can be received after 20 years of service with no minimum pensionable age, so some of them get recruited at the age of 20 so they can already retire at the age 40. And you know how long their lives are, right?" he said.

"Military people, they live longer than us, OK, some at the age of 90, OK. So, they retire at 40 to get their pension up to age 90. Isn't that ridiculous?"

The Philippines' Congress and economic managers have been pushing to overhaul the police and military pension system for over a decade (archived links here and here).

This group's retirement benefits are currently shouldered fully by the government, with no contributions from retirees' salaries during their active duty. Their pensions also receive a corresponding raise when salaries of current personnel are increased.

Diokno warned during the press briefing that this could result in the country's "fiscal collapse".

President Ferdinand Marcos asked Congress in his second State of the Nation Address on July 24 to make reforming the police and military pension system a priority (archive here).

The Philippines' pension system for the rest of the population is managed by two agencies – the Government Service Insurance System (GSIS) for government employees, and the Social Security System (SSS) which caters to non-government workers (archived links here and here).

Representatives for both agencies said there were no plans to change the state pension age for the general population.

"As of now, it's still 60 for optional retirement and 65 for compulsory retirement," Mercedita Irene Tayag from GSIS' corporate affairs department told AFP on July 24.

"The retirement age of those working in the private sector remains unchanged. SSS members have an optional retirement age of 60 and a technical and compulsory retirement age of 65," SSS spokesperson Carlo Villacorta told AFP on July 28.

He added that mine workers and racehorse jockeys may retire at 50 years and 55 years old respectively.

"We also want to note that SSS and the Military and Uniformed Personnel Pension System are two separate pension schemes guided by different policies and guidelines," Villacorta said.

Philippine fact-checking organisation Vera Files has also debunked this claim.

Copyright © AFP 2017-2026. Any commercial use of this content requires a subscription. Click here to find out more.

Is there content that you would like AFP to fact-check? Get in touch.

Contact us